Her Majesty’s Revenue and Customs (HMRC) yesterday released a policy paper, detailing cryptocurrency tax guidelines for individuals. The good news is that no new punitive tax measures apply to crypto, which essentially falls under existing taxation schemes.

Which Tax Applies?

After defining what a crypto-asset is, the paper notes that the nature of the industry requires a continually developing tax perspective. It breaks down the difference between exchange, utility, and security tokens, although the guidance within applies specifically to exchange tokens.

The tax treatment, however, is not dependent on the definition of the token, but on its nature and use. In simple terms, crypto-assets received as a form of payment will be liable for income tax. Those held as a personal investment will be subject to capital gains tax, but only on disposal.

Cryptocurrency Tax Liabilities

Income Tax and National Insurance contributions are liable on crypto-assets received in the following circumstances:

- Non-cash payment for employment or services rendered

- Mining fees or awards – where the mining activity is not at the degree where it would amount to a taxable trade.

- Financial trading in cryptocurrency – where the level of organization and frequency amounts to financial trade.

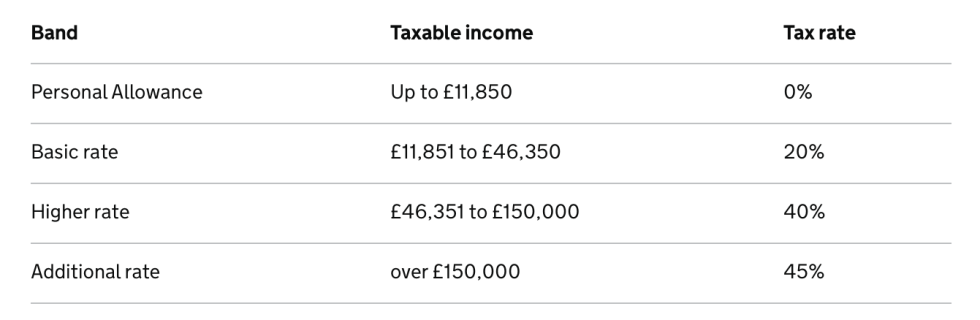

As crypto-assets gained through these activities count towards total earned income, the level of tax payable depends on tax bracket.

Capital Gains Tax

In most cases, HMRC expects that the buying and selling of crypto-assets by an individual will amount to investment activity. As with any other asset, this requires payment of tax on any gains realized at the point of disposal.

For the purposes of crypto-assets, disposal may include:

- Selling for money

- Exchanging for other types of crypto-asset

- Using as payment for goods or services

- Giving away to another person – who is not a spouse or partner

Charity donations are not usually subject to capital gains tax. Special rules apply to pooled assets (those which a person acquires over time and at different prices), regarding initial purchase cost.

Rates of capital gains tax are 20% for higher or additional rate taxpayers, and 10% for basic rate taxpayers. If your gains plus your income fall within your personal allowance then zero tax is due.

The Bottom Line

This is a very clear and well-written paper, and it is refreshing to see the British government eschew the “Crypto bad!” mentality, favored by some. By treating crypto-assets as regular income and/or investments, dealing with them should be made easier, as most taxpayers (and all tax professionals) will already be familiar with these processes.

Interestingly, the Bank of England posted a Twitter poll this week, asking for respondents preferred way to receive Christmas money. No prizes for guessing what’s coming top. Although perhaps somebody should tell the BoE that ‘bank transfers’ are ‘digital currency.’

Additionally, acceptance of bitcoin and other cryptocurrencies by the government for tax payment could also be on the horizon. Earlier this month, Bitcoinist reported that UK Member of Parliament, Eddie Hughes, has called for local authorities to take a lead, and accept Bitcoin payments.

Do the cryptocurrency tax guidelines help mainstream adoption? Let us know in the comments below!

Images courtesy of Shutterstock, Twitter