Cryptocurrencies are going through a very good period right now, and some people are likely to walk away with a nice return on their investment as 2024 draws to a close. But this is also good news for the IRS when it comes time for your next tax bill.

When it comes to keeping your tax bill as low as possible, however, crypto losses can also be your friend. You can use them to offset profits you made elsewhere in your crypto portfolio. With good times potentially ahead for crypto coins like Solaxy ($SOL), your tax position is something you should be looking at sooner rather than later.

Crypto Profits Are Taxable Profits

Meme coins are in the ascendant right now, with many of them – Crypto All-Stars ($STARS), Wall Street Pepe ($WEPE), and CatSlap ($SLAP), to name a few – promising high staking yields and higher prices. As investors take advantage of the bullish markets, it can be hard to forget that a percentage of any profits legally need to go to the government.

The IRS is making big changes to the rules starting on January 1st, so unless you do a bit of advance planning, you could find yourself handing over more of your crypto wins to Uncle Sam than you’d hoped for. Thinking ahead to your next one or two tax bills, therefore, makes sense, including how to offset them with your losses.

Of course, we’re not lawyers or accountants, so we can’t give tax advice. We can give you some broad strokes hints, but you should always double-check everything we say with your accountant. Everyone’s tax liabilities are different, so what applies to some people won’t necessarily apply to others.

So When Does Crypto Become Taxable?

It helps to start by defining what the IRS considers to be taxable when it comes to crypto. According to this Forbes article, you’ll need to pay tax on your crypto gains when you’re:

- Selling any of your crypto balances for fiat currency

- Trading one cryptocurrency for another one

- Spending your crypto balance on goods or services (many wallets, like Coinbase, now offer debit cards)

- Earning crypto through staking, mining, or rewards, which is something investors really need to watch out for, when staking new meme coins

- Receiving airdrops or hard forks

If you’ve done any of these things during 2024, you need to ask your accountant for a Form 8949, Schedule D, or Schedule 1.

So, How Can Your Crypto Tax Bill Benefit From Losses?

You should ideally be putting aside 25%-30% of your crypto wins for the tax man. But you could potentially make your bill lower by adding your crypto losses to the tax return. This is completely legal. However, you need to do this by December 31st to take advantage of this for your 2024 tax bill.

Using losses to offset a tax bill is known as tax loss harvesting. This is when you look at your assets and decide which ones are underperforming and currently causing losses for you. You can then sell them at a loss and report that loss to the IRS, who will then hopefully accept them and take them off your bill. In some cases, those losses may even apply to tax bills in future years.

This all serves to illustrate that making losses can have a silver lining.

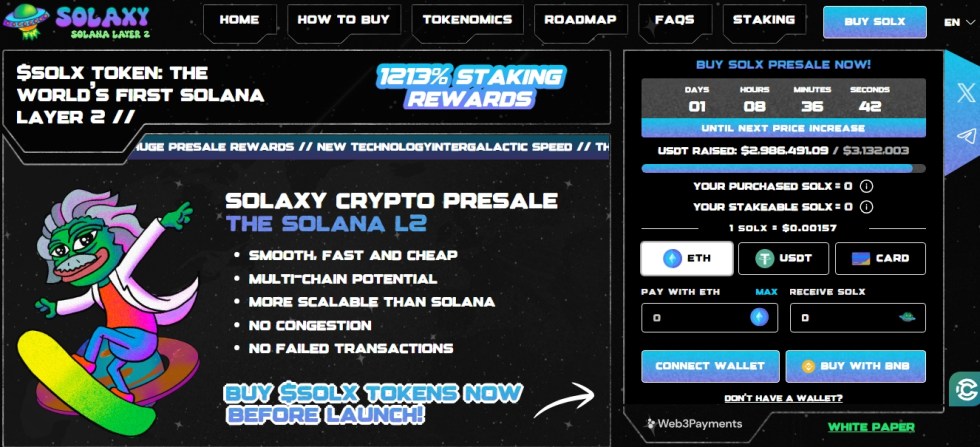

Signs Look Good For Solaxy

At the beginning of the article, we mentioned Solaxy ($SOL) which is one coin doing extremely well at the moment. It’s the first Solana Layer 2 protocol designed to tackle congestion and scalability issues, which is what’s getting it a lot of attention right now.

While others like Wall Street Pepe and CatSlap are slightly declining at the moment, Solaxy is going in the opposite direction. It’s seeing gains of almost 200% with a current token price of $0.00001839, and a staking APY of 1,280%. So this would definitely be one to consider including in your portfolio.

Don’t Take Our Word as Gospel – Consult an Accountant!

What we’ve outlined here are merely generalizations. You should always consult an accountant or a tax lawyer to make sure the rules apply to your current situation. Like investing in new crypto possibilities, always do your own research!