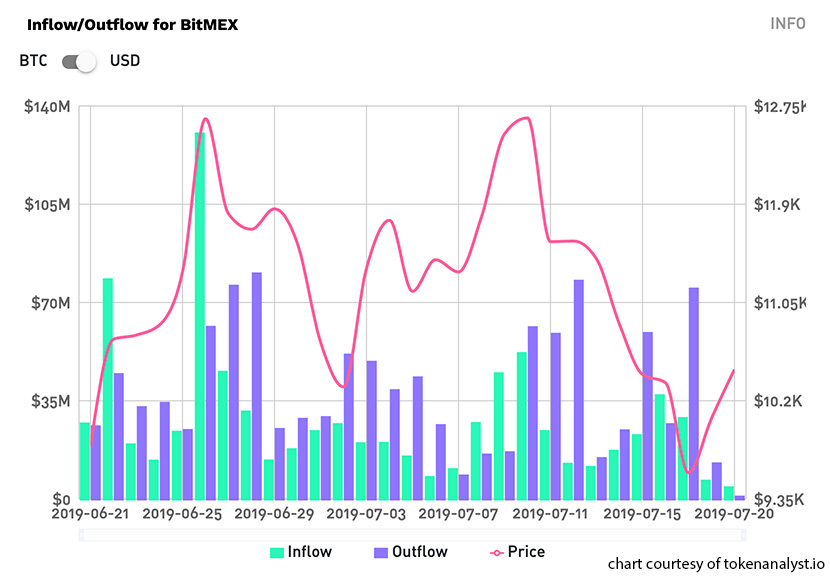

Bitmex has seen net outflows of $73 million worth of Bitcoin in 24 hours. This followed reports that the CFTC was investigating the exchange for allegedly servicing US traders.

Panic Leaving Or Business As Usual?

The outflows were first reported in a tweet from London-based Token Analyst. Most of the listed exchanges (Binance, Bitstamp, Bittrex, and Poloniex) have similar amounts flowing both in and out. However Bitmex is notable for its disparity, with only $12 million coming in, whilst $85 million has flowed out.

🚨 24H BTC exchange on-chain flows:#binance: $58M in | $54M out#bitstamp: $52M in | $50M out#bittrex: $4M in | $5M out#poloniex: $6M in | $4M out#bitmex: $12M in | $85M out

See more at https://t.co/6AFFM1D63p

— TokenAnalyst (@thetokenanalyst) July 20, 2019

Some speculated that this was due to panic leaving. News broke yesterday that the Commodity Futures Trading Commission (CFTC) is allegedly investigating the exchange. However, many countered that considering the volume of BTC on the Bitmex platform, it perhaps wasn’t such a being deal. Certainly there is historical precedence for these kind of figures.

So What’s The Potential Panic?

Well, the reported CFTC investigation revolves around whether Bitmex was providing services to US traders. Because cryptocurrencies were ruled to be commodities in the US, any platform allowing trading by US citizens needs to be CFTC-registered.

The platform’s terms of service do list the US as a restricted jurisdiction, and customers have reported that their accounts have been shut down on suspicion that they were US customers.

However most cryptocurrency traders would have no problem setting up a VPN in order to get around geo-blocking or other such restrictions. In fact, Binance CEO, CZ, is among many who advocate for the use of VPNs at all times online.

In which case, is the exchange at fault or the trader?

It is possible that the recent out-flows from Bitmex represent American traders withdrawing funds from the exchange in order to keep them from the CFTC. However this is by no means certain.

Additionally, though some suggest that this amount of BTC will find its way onto the spot markets, there is nothing to really indicate that this is the case. It is likely that much of this liquidity will find its way onto other exchanges or even hardware wallets.

Even if it were to be sold off, that sort of amount shouldn’t cause a substantial dip in BTC price.

What do you think about Bitmex’s recent outflows? Let us know your thoughts in the comment section below!

Images via Twitter @Tokenanalyst, Shutterstock