Altcoins have managed to outshine the allure of Exchange-Traded Funds (ETFs) in recent months. The resurgence of risk appetite and the promise of double-digit yields are driving traders towards alternative digital assets.

ETFs are investment vehicles that allow investors to gain exposure to a diversified portfolio of assets, such as stocks, bonds, or commodities. They are traded on stock exchanges, making them accessible to a broad range of investors. In contrast, altcoins are a category of cryptocurrencies other than Bitcoin. Prominent examples include Solana, XRP, and Chainlink, each with its unique features and use cases.

In recent days, major altcoins like Solana, XRP, and Chainlink have experienced substantial double-digit gains, attracting traders seeking high returns. The enthusiasm for these digital assets has led to an increase in leverage, as analysts observe traders borrowing funds to amplify their investment positions.

Altcoins: Advances And Market Activity

The week has seen notable surges in the prices of several major altcoins. Solana, a blockchain platform known for its high-speed and low-cost transactions, has garnered significant attention. Alongside it, XRP, the digital currency associated with Ripple, and Chainlink, an oracle network, have also demonstrated remarkable price increases.

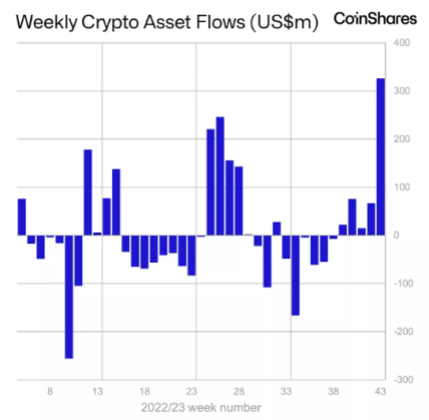

Source: Bloomberg and CoinShares

Investors have poured funds into Polygon and Cardano, as indicated by CoinShares data, showing an influx of $800,000 and $500,000, respectively, in the past week. Solana, in particular, has seen substantial net buying, with Coinbase leading the way. Data reveals that 2.2 million Solana tokens were market-purchased between October 18, coinciding with the start of the rally, and Nov. 6.

As the market breadth of the crypto rally improved and a probable end to the Federal Reserve’s rate-hiking cycle offered a more supportive environment for risky assets, investment advisory firm ByteTree hinted at the early innings of an “alt season” – a prolonged phase of the wider altcoin market outpacing Bitcoin’s price.

Total crypto market cap at $1.3 trillion on the 24-hour chart: TradingView.com

Bitcoin’s Enduring Appeal And ETF Enthusiasm

While altcoins enjoy renewed interest, Bitcoin remains a steadfast choice for investors. This enduring appeal is partly attributed to the recent dip in bond yields while still maintaining relatively high levels. Noelle Acheson, the author of the ‘Crypto is Macro Now’ newsletter, suggests that the sustained enthusiasm for ETFs contributes to Bitcoin’s continued attraction.

However, it’s important to exercise caution when it comes to ETF optimism. Craig Erlam, a senior analyst at Oanda, highlights the importance of considering broader macroeconomic conditions. Investors are currently grappling with hawkish commentary from central banks worldwide, contrasting with pessimistic economic expectations and speculations surrounding potential rate cuts in the coming year.

Market Insights

As investors rekindle their interest in altcoins, the cryptocurrency market’s dynamics are evolving rapidly. Double-digit yields and the promise of significant returns have lured traders back into the altcoin arena. While ETFs remain a favored investment avenue, the crypto space is once again proving its resilience and potential for high-growth opportunities.

It’s important to note that this renewed altcoin fervor is not without risks, and investors must remain vigilant in the face of shifting macroeconomic conditions and evolving central bank policies. In this ever-changing landscape, the appeal of altcoins, like Solana, XRP, and Chainlink, shows that cryptocurrency’s allure is far from fading, promising continued excitement and opportunities for savvy investors.

Featured image from Shutterstock