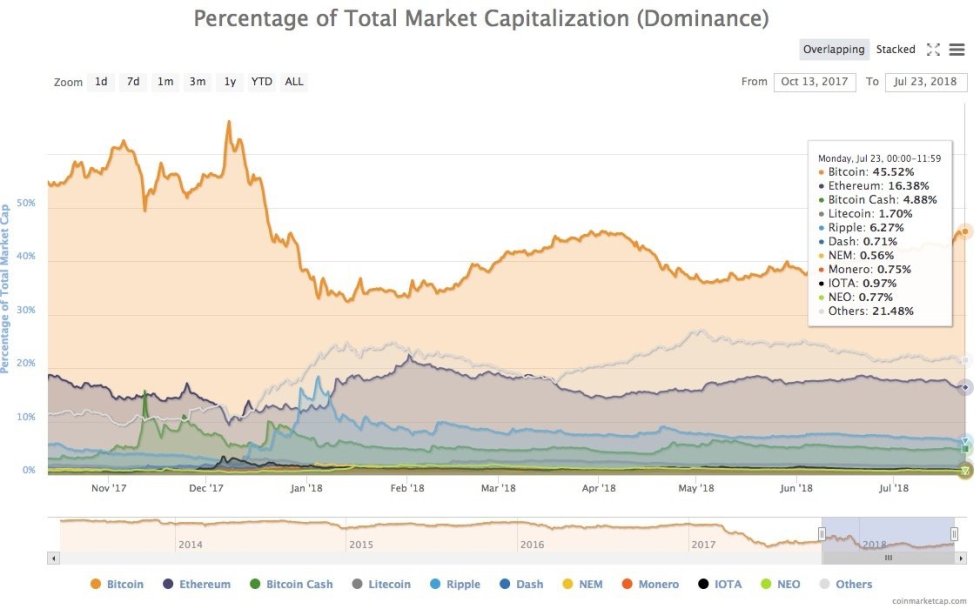

An index measuring Bitcoin dominance is now over 45.7 percent — its highest since December 2017 when the price of BTC reached its all-time record high.

Bitcoin Dominance Up 10% in 2018

Bitcoin dominance measures Bitcoin’s percentage of the total cryptocurrency market share by market capitalization. The controversial index has been trending upward for most of the year and is up over 10 percent since January 2018.

Bitcoin dominance has surged over the past two weeks, in particular. With the current bullish uptick in BTC price [coin_price], most altcoins have been left in the dust.

Bitcoin has proved to be one of the most stable digital assets amid a massive 70 percent market-wide correction with many altcoins still struggling despite Bitcoin now showing signs of recovery.

Namely, XRP [coin_price coin=ripple] and Ethereum [coin_price coin=ethereum] are responsible for most of the altcoin bleeding. Ripple’s market share has dropped from an all-time high of 18.5 percent in January to 6.2 today. Meanwhile, Ethereum currently holds 16.33 percent of the market — or just half of its all-time high mark of 33 percent set in June of last year.

Bitcoin: De Facto Store of Value

Bitcoin remains dominant because it’s the de facto store of value in the cryptocurrency market.

Yes, it is the oldest blockchain with first mover advantage and impressive 99.99 percent uptime — but it’s also the most battle-tested and most immutable (with the highest hash rate) blockchain with the biggest network effect. Hence, it is no surprise that it inspires the most confidence among cryptocurrency investors.

Bitcoin Dominance now above 45%

Large alts underperforming in anticipation of a Bitcoin ETF? https://t.co/yLJGIhaOWs— Alistair Milne (@alistairmilne) July 20, 2018

Meanwhile, others like UK entrepreneur and Bitcoin investor Alistair Milne attribute Bitcoin’s rising dominance to the Bitcoin ETF decision expected next month. Therefore, traders may already be betting on a positive decision as the fund would open the floodgates for traditional finance to get into cryptocurrency.

‘Irrelevant’ Metric

Admittedly, the Bitcoin dominance index is not very reliable. It is a purely quantitative metric and one that doesn’t accurately depict a market that is obsessed with novelty.

“Stop using Bitcoin dominance as an indicator. As soon as people started with premines/tokens and (BTC) airdrops it became irrelevant,” writes Twitter personality WhalePanda. “I can create a WP-token, create $1 trillion, sell 1 token for $1 on an exchange and I’m a trillionaire with WP being the dominant coin.”

WhalePanda does have a point. Literally, anyone can now create their own cryptocurrency to further dilute Bitcoin’s overall market share. In fact, 2018 will likely be a record year with thousands of new cryptocurrencies expected to launch.

Nonetheless, Bitcoin dominance has been climbing this year despite an ever-increasing number of ‘cryptos’ entering the fray. “Liquidity and value being sucked out of altcoins and into BTC,” writes another Twitter commentator P.Miller. He notes:

Despite there being dozens more altcoins launched, the ‘bitcoin dominance’ has increased from 32% to 45%. This shows significant strength of Bitcoin as THE store of value in ecosystem.

Will Bitcoin dominance continue to creep up this year? Share your thoughts below!

Images courtesy of Shutterstock, Coinmarketcap.com, Twitter.