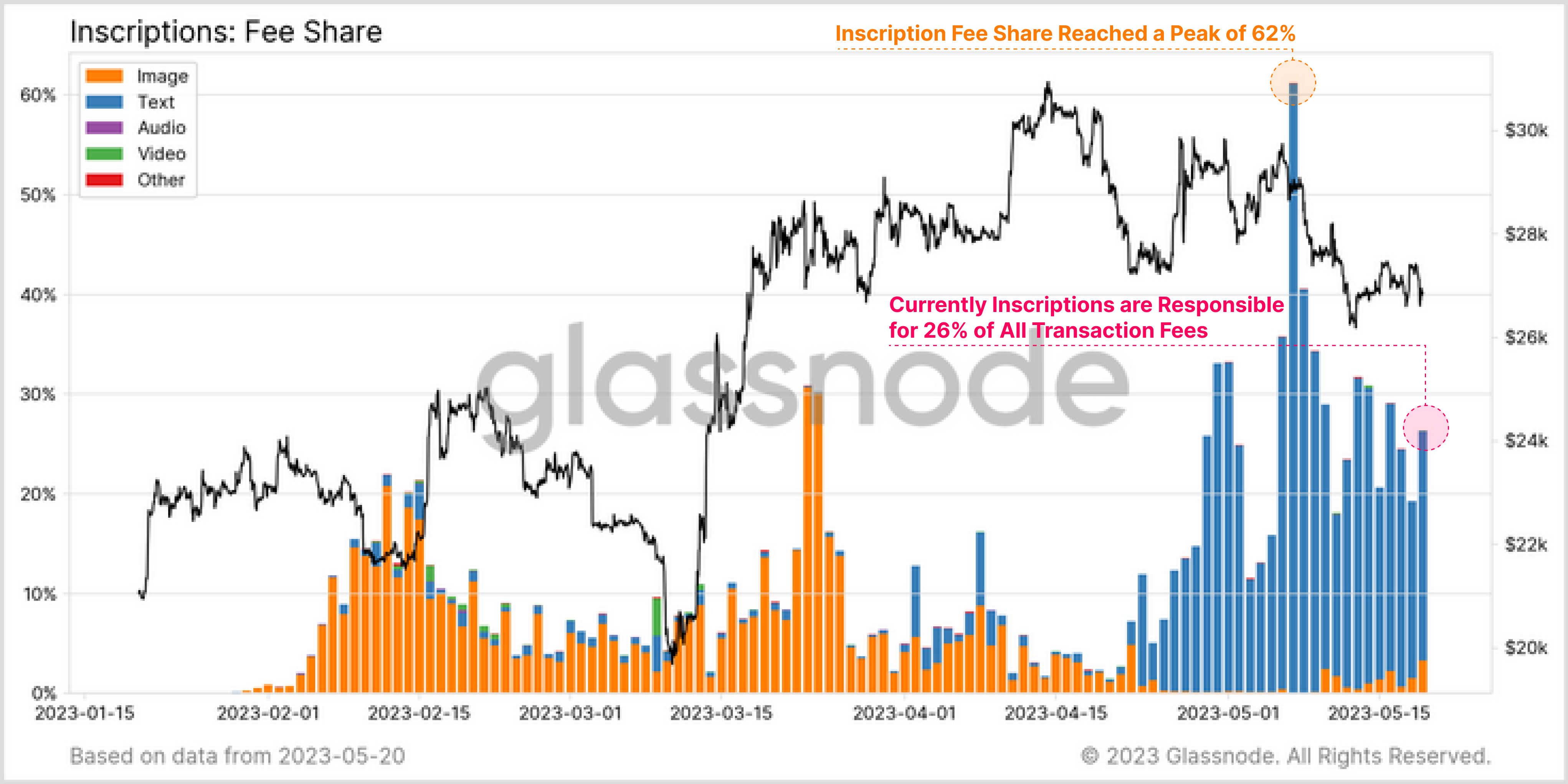

Data shows the Bitcoin transaction fee share of the Inscriptions has dropped to just 26% recently, a sign that the hype around them may be fading.

Bitcoin Inscriptions Fee Share Remains High, But Much Lesser Compared To Peak

According to data from the on-chain analytics firm Glassnode, the fee dominance of the Inscriptions was at 62% during their peak. An “Inscription” here refers to any form of data directly inscribed into the Bitcoin blockchain.

The Inscriptions only became possible when the Ordinals protocol emerged earlier in the year, and since then, they have seen a number of applications and have earned some rapid popularity.

As Inscription transactions are like any other transfer on the network, they naturally influence the blockchain economics related to transactions. An easy way to gauge the impact of the Inscriptions is through the Bitcoin transaction fees.

Generally, the transaction fees vary based on the amount of demand on the network. In times of low traffic on the blockchain, investors have no need to pay any significant amount of fees to get their transfers completed quickly, so the fees stay low.

When there is high congestion on the network, however, holders may have to attach a high amount of fees as there is a large amount of competition for the limited transaction capacity that the miners have.

Now, here is a chart that shows the percentage share of the transaction fees that the Bitcoin Inscriptions have occupied since their inception:

Looks like the value of the metric has come down a bit recently | Source: Glassnode on Twitter

As displayed in the above graph, the Bitcoin Inscriptions fee share had burst up not too long after the tech had first emerged. Most of the contribution was coming from the image-based Inscriptions (colored in orange in the chart), which were playing the role of non-fungible tokens (NFTs) on the network.

In April, however, the image Inscriptions fad had died out and the transaction fee share of this type of transfer had registered a decline to low values.

Not too long after the drop in interest around the Inscriptions, though, a new application of the technology had come forth: the BRC-20 tokens.

The BRC-20 tokens are fungible tokens similar to the ERC-20 tokens on the Ethereum blockchain and are created in the same form as the text-based Inscriptions.

From the chart, it’s visible that the fee transaction share of the Inscriptions had risen to a new all-time high (ATH) after the BRC-20 tokens had emerged, with most of the transfers unsurprisingly coming from the text-based type (highlighted in blue).

At the ATH, the metric’s value had reached around 62%, meaning that the Bitcoin miners had been receiving 62% of the total transaction fees from the Inscription-based transfers.

In the last few days, however, the interest around the Inscriptions looks to have once again lightened, as the fee share of such transfers has dropped to 26%.

This is obviously still a pretty high level, but nonetheless represents a very significant decline from the peak.

BTC Price

At the time of writing, Bitcoin is trading around $26,800, down 2% in the last week.

BTC has gone stale in the past few days | Source: BTCUSD on TradingView