After cryptocurrencies began their climb on Friday, surpassing $27,000 for the second time this week, Bitcoin price has regained nearly all of its losses from 2022.

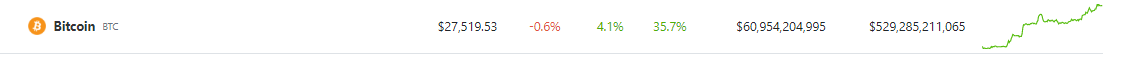

In recent days, the cryptocurrency markets have escaped the grip of bears, with the majority of tokens breaking out of upward consolidation. At the time of writing, Bitcoin was halfway its $28K target – its highest since nine months ago – trading at $27,519, an increase of 36% over the previous week, according to statistics from crypto market tracker Coingeckos.

Source: Coingecko

Bitcoin Price Shows Resilience

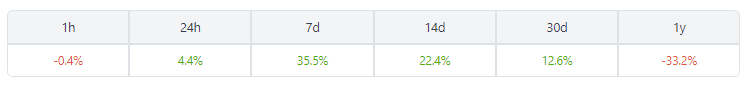

The price of Bitcoin rose 22% in the last two weeks and 13% in the last 30 days, according to the most recent data. The rise has raised the worldwide crypto market capitalization by over 5.4%. While some market experts say this to be a short-term bounce, a more significant price move appears imminent.

Source: Coingecko

The overnight data from the Federal Reserve’s balance sheet indicating the injection of about $300 billion into the economy as part of the reaction to the banking crisis acted as a spark for new gains.

Bitcoin Emerges Victorious From Banking Crisis

In the wake of last week’s banking crisis, investors have applauded the resilience of cryptocurrency prices. It began with the closings of Silicon Valley Bank and Signature Bank late on Sunday, but throughout the week the spotlight was on First Republic Bank. Some major U.S. financial institutions came to its help late Thursday, depositing a total of $30 billion.

In light of the recent instability in the financial sector, many have stated that Bitcoin’s narrative is shifting. Inflation and Federal Reserve rate hikes continue to have a significant impact on the price movements of the cryptocurrency.

The bitcoin market may have mixed effects from the Fed’s rate move. A rate hike can raise borrowing costs, which can reduce demand for cryptocurrencies as investors seek safer and more reliable investments.

A rate hike can result in a boost of the U.S. dollar, which can render cryptocurrencies more expensive for foreign investors. Alternatively, as interest rates rise in the traditional financial markets, some investors may turn to cryptocurrencies as an alternate investment choice.

BTC total market cap at $528 billion on the weekend chart at TradingView.com

Crypto: Cushion Against Inflation

This is because virtual currencies are frequently viewed as a hedge against inflation and an alternative form of asset storage. In addition, some analysts assert that a rate hike can raise the appetite for cryptocurrencies as consumers strive to diversify their investments and safeguard against prospective economic downturns.

Ultimately, the influence of a Federal Reserve rate hike on the cryptocurrency industry is complex and can depend on a number of variables, such as the precise economic circumstances at the point of the rate hike and the investor sentiment towards cryptocurrencies.

The next Bitcoin pricepoint is eagerly awaited as numerous investors want to increase their portfolio returns. This expected price corresponds with a 2023–2030 expert forecast for Bitcoin.

-Featured image from NASA