Data shows the crypto futures market has seen liquidations of nearly $180 million during the past day as Bitcoin has surged toward $29,000.

Crypto Futures Market Registered High Liquidations In The Last 24 Hours

The “liquidation” of a futures contract happens when the holder accumulates losses equal to a specific percentage of the margin (the initial collateral), leading to the derivative exchange with which the position is open to forcibly close the said contract.

In the crypto sector, it’s not unusual to see a mass amount of liquidations happening at once because of the nature of the market. There are mainly two factors that can significantly affect the risk of a contract being liquidated: the amount of leverage being used by the investor, and the volatility of the coin the position is for.

The “leverage” here refers to a loan amount that an investor may opt to take on against the margin. The benefit of taking on leverage is naturally that any profits earned will become more by the same factor as the leverage.

There is also, however, an obvious catch with it; any losses are also magnified by the leverage. In the crypto sector, there are many exchanges that offer easy access to high amounts of leverage (even as high as 100x the position).

Most of the assets in the market are generally quite volatile, as their prices can sometimes show significant fluctuations in a single day (Bitcoin has, for instance, moved 8% in the last 24 hours).

When both the above factors are combined, it becomes easy to see why the futures market can be risky to navigate for the uninformed trader in the crypto sector.

In the past day, there has been sharp price action in the market, which has resulted in the liquidation of a large number of traders.

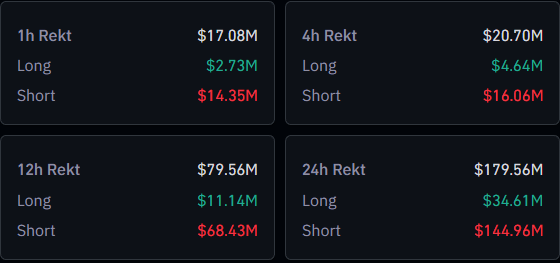

Here are the numbers associated with this futures flush:

A large amount of liquidations seems to have occurred during the past day | Source: CoinGlass

As you can see above, almost $180 million in crypto futures contracts have observed liquidation during the last 24 hours. The vast majority of this flush (around $145 million, or 77%) looks to have involved the short traders, a fact that would be expected as the main trigger behind this mass liquidation event has been a rapid upswing in the prices of Bitcoin and other assets.

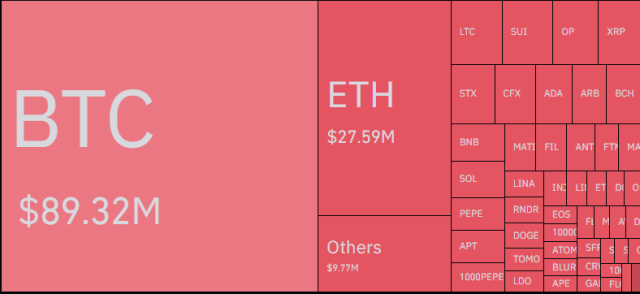

In terms of the individual contributions to this liquidation flush by each symbol, it would appear that Bitcoin has accounted for the largest portion of the liquidations at about $89 million, as the data below suggests.

Looks like BTC is at the top of the list | Source: CoinGlass

Ethereum has registered the second largest liquidations in the market at about $27 million, while Litecoin has been third at around $3 million.

BTC Price

At the time of writing, Bitcoin is trading around $28,900, up 11% in the last week.

BTC has observed a sharp surge during the past day | Source: BTCUSD on TradingView