- After a short bout of trading above $11,000, Bitcoin has witnessed massive inflows of selling pressure that have slowed its ascent and stopped it from seeing any major upside

- The cryptocurrency is now at grave risk of seeing further losses, with analysts noting that it may soon visit its key $10,200 support

- A break below this level could lead to serious losses, with bears potentially moving to fill the CME gap that exists around $9,700

- There do appear to be a few key factors behind this move, with spike in exchange inflows, strength in the US Dollar, and technical weakness all pushing it lower

Bitcoin and the entire cryptocurrency market are witnessing some blood today. BTC’s price has faced a severe correction following a short-term bout of trading above $11,000.

This recent upswing came about after an extended period of consolidation within the upper-$10,000 region. The crypto was able to venture as high as $11,200 before it lost its momentum and slid lower.

While speaking about this, one analyst explained that there are a few factors likely perpetuating this move, with technical weakness resulting from the recent rejection being just one.

Bitcoin Struggles to Find Support as Selling Pressure Ramps Up

Bitcoin and the entire market are seeing a red day, with BTC’s decline creating massive headwinds that have erased nearly all the gains posted by altcoins in recent times.

At the time of writing, Bitcoin is trading down over 3% at its current price of $10,600. Bulls have established this price as a slight region of support, although it is important to note that it has yet to post any ardent response to tapping this level.

Until it reaches the lower-$10,000 region it may not find any massive buying pressure. This means that further short-term losses may be imminent for BTC.

Analyst: These Factors are Likely Behind Today’s BTC Plunge

One analyst, while speaking about Bitcoin’s technical outlook, explained that he sees a few main factors that are driving this move lower.

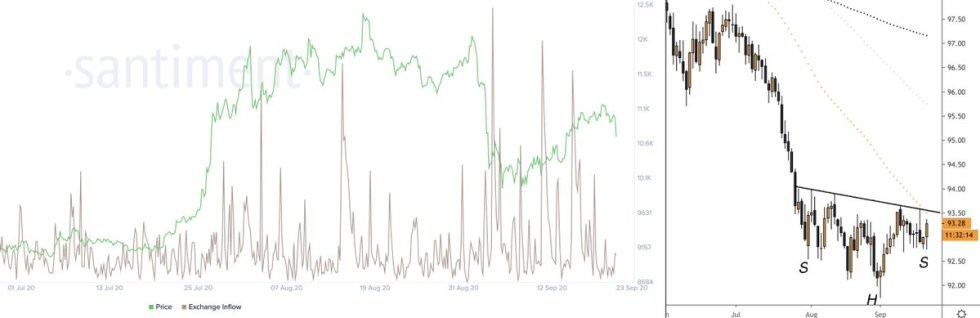

He points to a trend seen while looking towards exchange inflows, strength in the US Dollar Index (DXY), and technical uncertainty.

“There’ve been decreasing onchain spikes of exchange inflows recently indicating short-term selling pressure increase. Combined with DXY and its uncertainty from the technical side (sideways, head & shoulders), it adds to BTC XAU XAG volatility,” he said.

Image Courtesy of CryptoBirb.

How Bitcoin and the crypto market trend next may depend largely on how the benchmark stock indices trade in the coming few days.

Featured image from Unsplash. Pricing data via TradingView.