On-chain data shows Solana and other top cryptocurrencies have seen a decline in trading volume recently. Here’s what this says about the market.

Solana, Bitcoin, And Ethereum Trading Volumes Have Declined Over Past Month

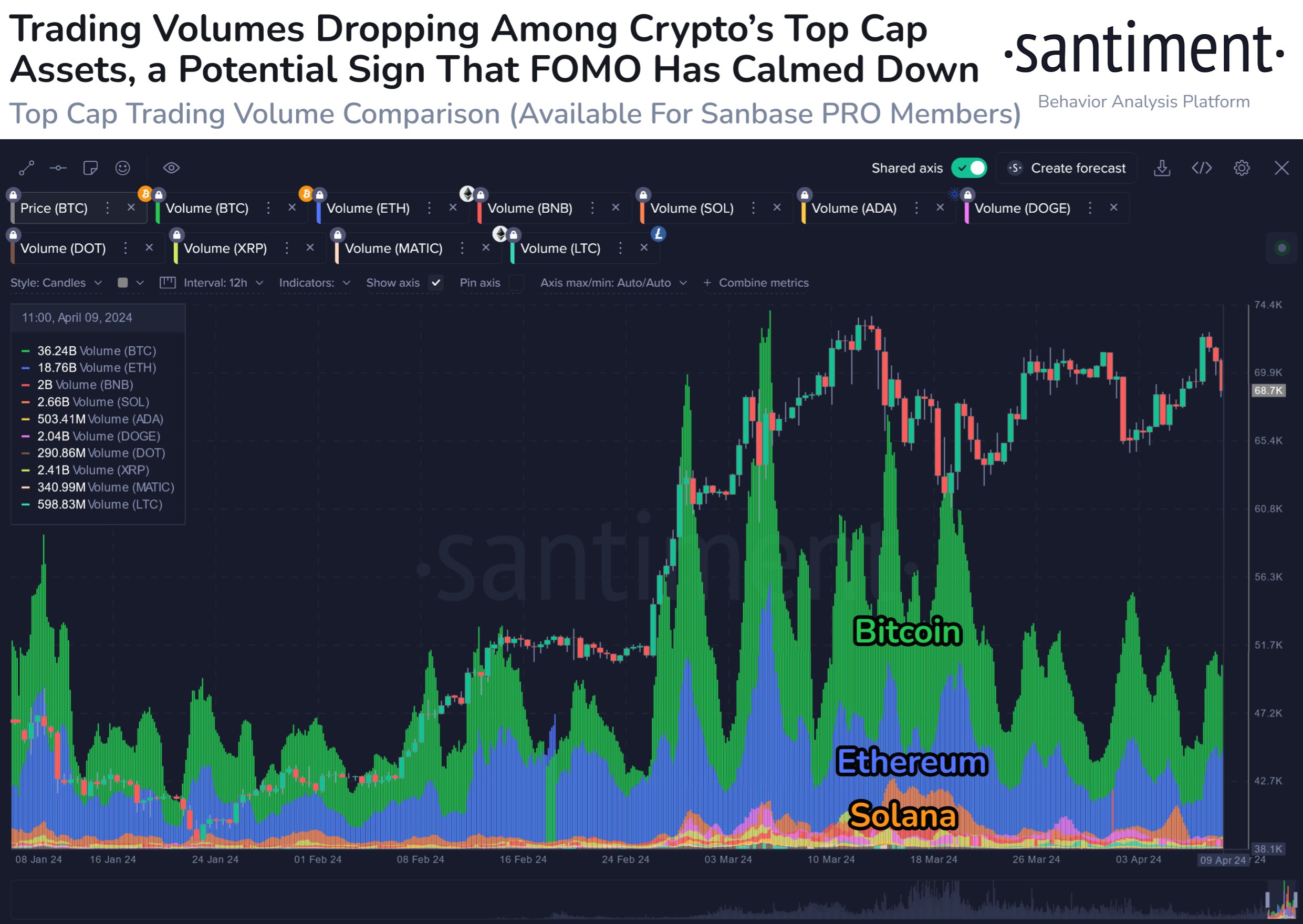

According to data from the on-chain analytics firm Santiment, the cryptocurrency market’s trading volume has been declining since its peak in early March.

The “trading volume” here refers to the total amount of any given asset involved in trades on the various spot cryptocurrency exchanges.

When this metric’s value is high, it means that many coins are being shifted around on these platforms, suggesting that trading interest in the given asset is high right now.

On the other hand, low indicator values can imply that the cryptocurrency market is currently inactive. Such a trend may be a sign that general interest in the coin is currently low.

Now, here is a chart that shows the trend in the trading volume for various top assets in the sector, like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL):

Looks like the value of the metric has gone down for all of these coins recently | Source: Santiment on X

As displayed in the above graph, the trading volume across these top cryptocurrencies shot up in late February and continued to witness such values into the first days of March.

On March 6th, in particular, the indicator observed an especially pronounced peak. Since this high, though, the metric has been stuck in a gradual state of decline.

“This appears partly due to the ranging pattern that began in mid-March, causing less confidence in traders making the right decision,” explains the analytics firm.

Bitcoin has naturally occupied the largest trading volume share of all the assets, while Ethereum, the second-largest coin, has seen the second-greatest portion.

Interestingly, out of the altcoins, Solana has generally tended to stay number one despite the fact that BNB (BNB) has a greater market cap. For SOL, the peak in volume came a bit later than BTC and ETH, perhaps as a result of the coin continuing to see an uptrend while many others slumped down in mid-March.

However, the volume eventually sank for Solana, aligning with the trend followed by the other top assets. Thus, it would seem that the interest in the market as a whole has been on the downturn recently.

“Once Bitcoin, Ethereum, and other top caps begin to establish a consistent direction once again, expect consistent trades to begin rising once again,” says Santiment.

SOL Price

The past week hasn’t been the best of times for Solana investors as the asset’s price has dropped more than 12% inside the window, taking its price to just $165.

The price of the asset appears to have plummeted over the past few days | Source: SOLUSD on TradingView