If you think the amount of money lost during Bitcoin’s $2,000 plunge last week was a lot, it was barely a blip compared to the $1 trillion in market cap lost among the top six tech stocks this week.

But why was the collapse in tech stocks so violent, and what does this mean for the first-ever cryptocurrency?

Top Tech Stocks See Over $1 Trillion Eliminated In Three Days, But What’s This Mean For Crypto?

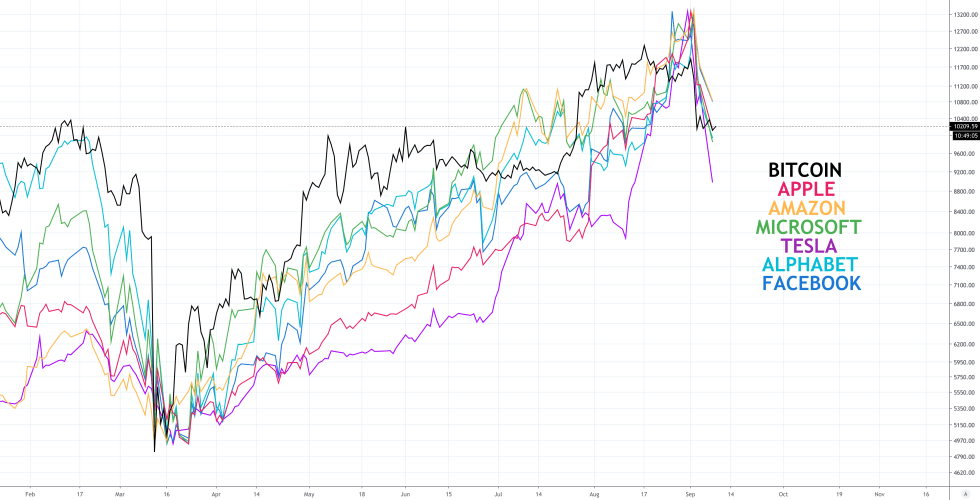

Last week, the crypto market began to collapse after an over 80% year-to-date market-wide rally and over 60% returns for the year in Bitcoin. The cryptocurrency had been the best-performing mainstream asset in the year, even beating out top tech stocks like Amazon, Microsoft, Alphabet, Facebook, Alibaba, and Apple.

These same top six tech stocks this week plummeted by a combined over $1 trillion in market cap lost. Analysts have pointed to these companies being overvalued, and have only ballooned further since the start of the pandemic.

RELATED READING | RECENT BITCOIN TOP SHARES KEY SIMILARITIES WITH BLACK THURSDAY PLUMMET

These powerhouses tumbling by a trillion over three days helped drag down the Nasdaq 100 to one of its worst drops on record. And while a $2,000 drop in Bitcoin may be frightening, only about $30 billion has been lost in total BTC market cap. Even the entire cryptocurrency total market cap only lost $75 billion from the 2020 high to local low.

When looking at percentage lost, Bitcoin may stand toe-to-toe or even beat out stocks. But when it comes to total value destroyed, these tech stocks show just how small Bitcoin and crypto are by scope.

BTCUSD Versus Tech Stocks Comparison Chart | Source: TradingView

How Crashing Tech Stocks Highlight How Bitcoin Could Reach A $1 Trillion Market Cap

But it also demonstrates how massive Bitcoin could be someday. These tech giants can shake off $1 trillion in combined losses and still remain firmly at the top of the food chain. The amount they lost measures at five times the cryptocurrency’s currently under $200 billion market cap.

If over $1 trillion in value can disappear into thin air in just three days due to falling tech stocks, leaving them mostly unphased, then why is it difficult to imagine the Bitcoin market cap at $1 trillion or higher?

A $1 trillion market cap in the cryptocurrency would bring the price per BTC to around $50,000.

While Bitcoin’s low market cap currently tells investors it’s not yet taken as seriously as stocks or gold, it is for this same reason why many hedge funds expect Bitcoin to be a faster “racehorse” in the “race against inflation.”

RELATED READING | WHY HAS BITCOIN BECOME A LEADING INDICATOR FOR THE S&P 500?

The entire gold market cap is $11 trillion, and the crypto asset is proving to be a better-designed store of value than the precious metal. If this money eventually flows into Bitcoin, a $1 trillion market cap should be relatively easy to come by.

All of gold flowing into Bitcoin is unlikely. But at a market cap that size, the crypto asset would be valued at nearly $500,000 per BTC. The stock market total assets are valued at over $89 trillion and growing. Bitcoin’s share of that value would only represent 0.2%.

With so much capital free-floating in financial markets, it is foolish to think that if tech stocks and bleed out over a trillion in three days, that in three years, Bitcoin couldn’t reach a $1 trillion market cap or higher. And if that sounds logical at all, buying Bitcoin now could be incredibly rewarding.

Featured image from Deposit Photos.