Still licking its woods after a brutal weekend, Bitcoin has been able to maintain critical levels of support. At the time of writing, BTC’s price trades at $55.318 with side movement in the past 24-hours. In the weekly and monthly chart, BTC is down 12.6% and 3.5% respectively.

A report by QCP Capital highlights the Coinbase Effect on the crypto market. A high number of investors took leverage position expecting a rally after Coinbase’s debut in Nasdaq. However, the exchange’s shares top and along came a deleveraging weekend selloff, as the firm stated.

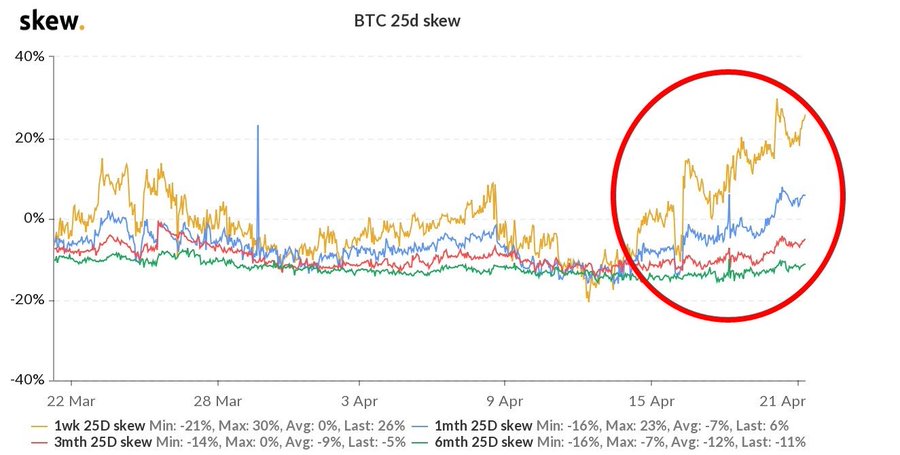

On Sunday, $10 billion were liquidated across the main trading platforms. This led to a “massive violent backwardation”. On Deribit, futures traded at a 25% discount and at a 40% discount on Binance. As can be seen in the image below, this exchange registered the largest number of liquidations.

QCP Capital set support for BTC’s price at $50,000 by the end of April and $40,000 by the end of Q2. If it regains bullish momentum, the cryptocurrency could retake $60,000 by month-end and $65,000 in May. However, the first sees likely that the correction will continue at least until next month. They added:

We think the market probably has it right this time in terms of pricing a low daily implied in the near-term. Although the trend break has indeed wrecked a whole lot of technical damage to the chart we’re still of the opinion that it means upside is more capped than before..

Analyst William Clemente is bullish on Bitcoin, despite the recent price action. After the flash crash, Clemente believes BTC’s major indicators are resetting. Therefore, the cryptocurrency has “a lot of room to run”. Clemente added:

I don’t think people realize how aggressive this next leg up will be, FOMO will be intense.

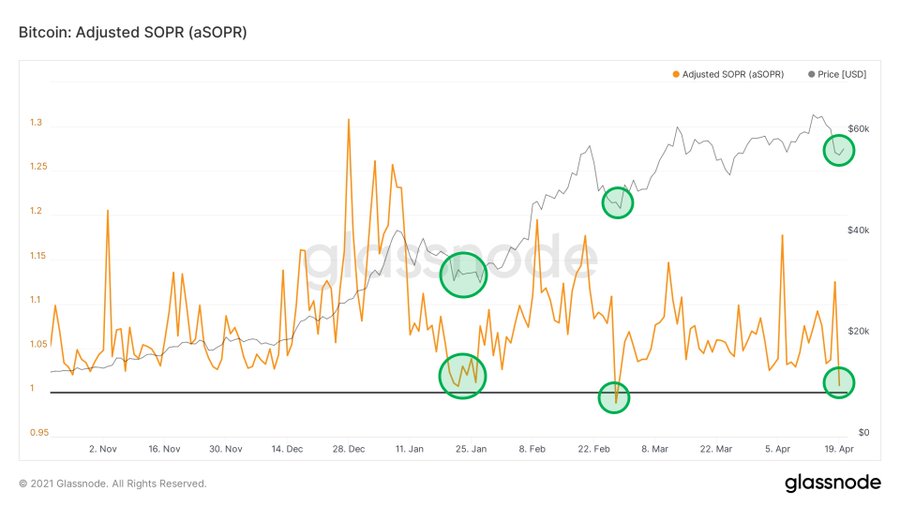

The metric UTXO Realized Price Distribution (URPD) sets support for Bitcoin at $47,243, $52,420, and major on-chain support at $55,009. In addition, the adjusted Spent Output Profit Ratio (SOPR), metric use to identify a market’s local top or bottom, indicates BTC has reached a zone that has preceded a rally, as shown in the chart below. Clemente added:

Bitcoin cycle tops aren’t caused by increase of sellers but rather a lack of buyers. If you think there’s no more demand coming in the next year, go ahead and sell your BTC, because you’re out of your mind.

What Does It Take To Break Bitcoin Bearish Trend?

QCP Capital outlines 3 key factors that could shake the current market’s dynamic. The approval of a Bitcoin Exchange Traded Fund (ETF) in the United States, a crackdown by authorities in this country, the reversal of quantitative easing (QE), a country’s practice of buying assets and securities, by the U.S. Federal Reserve.

On the first factor, just the news or delays about a Bitcoin ETF approval could have a role in the crypto market, as it has been in the past. Regulations to the sector, according to QCP Capital, will happen “sooner than people expect”, but it is unclear how Bitcoin will be affected. Finally, a change in the QE policy could be implemented in Q3, 2021.

QE has been one of the main drivers of Bitcoin’s rally, as stated by Sofia Blikstad, an analyst at Arcane Research. So, if the FED reverses it or slows it down, the crypto market could be negatively affected.