Here are four reasons why we at Bitcoinist believe the Trump presidency can make Bitcoin even greater in the next four years.

Making Bitcoin Even Greater

We at Bitcoinist believe the world’s most popular cryptocurrency is already great. Indeed, it has shown that it can weather any political storm. But what about the looming ‘Trumpocalypse’ that some political pundits have predicted?

Judging by Trump’s actions and comments thus far: Bitcoin will not only survive, but will also become greater than ever. Here’s four reasons why…

An Entourage of Bitcoin Supporters

Trump’s team includes some of the Bitcoin industry’s most well-known investors.

As Bitcoinist previously reported, among them is Peter Thiel, a serial entrepreneur who has been part of Trump’s transitional team for over a year. Various Thiel associates, themselves crypto startup investors, namely 21 Inc. CEO Balaji S. Srinivasan, are meanwhile contending for positions at the Food And Drug Administration (FDA).

In addition, Trump announced wildcard senator Mick Mulvaney as his budget chief last month. Also known as ‘Bitcoin Congressman,’ Mulvaney has been actively promoting Bitcoin education in Washington for several years, liaising with various community figures and launching a Bitcoin Caucus to raise awareness among politicians.

Mulvaney and fellow congressman Jared Polis are also working with the Coin Center, a Washington-based nonprofit that focuses on digital currency technology, to help Congress understand how it all works.

“For the past two years we have worked with Representatives Mulvaney and Polis to educate their colleagues through briefings and other events, and the new Congressional Blockchain Caucus will be a wonderful new platform to continue these efforts,” said Jerry Brito, executive director of Coin Center.

Their forward-thinking leadership on blockchain technology in Congress is unmatched.

Bitcoin: The Remedy to Protectionism

It is no secret that Trump’s policy is firmly focussed on strengthening domestic identity. Critics have long hailed the Trump era as a time when globalization will take a back seat and the US will look inward.

Bitcoin, as a borderless tool excluding no one – even those without the internet – is the antithesis of this stance. What’s more, as has been witnessed by various failed crackdowns worldwide in recent years, Bitcoin’s relentless spread is impossible to control.

An example lies in Trump’s expected new ally, Russia. Having previously sought to block information and trading sites connected with Bitcoin and other “surrogate currencies,” this month saw the country’s central bank officially admit that it had to work with Bitcoin rather than ban it and pretend it would go away.

Devil’s in the Dollar

Trump’s ingrowing toenail style fiscal policies have been slated as extremely bad news for the US budget deficit. Saxo Bank stated last month it expects Trump to increase the imbalance from “from $600 billion to $1.2-1.8 trillion,” which could propel the price to as high as $2,100 in 2017.

This, it says, will cause knock-on effects worldwide as the Federal Reserve increases interest rates, leading to an overly strong dollar and demand for alternatives among foreign investors.

“This leads to an increased popularity of cryptocurrency alternatives, with Bitcoin benefiting the most,” it concluded.

Moreover, he will inherit nearly $20 trillion dollars in US national debt that he hopes to alleviate by decreasing government spending and being “very strong on the debt limit.” He said:

OK, I would use the debt limit. I want to be unpredictable, because, you know, we need unpredictability. Everything is so predictable with our country. But I would be very, very strong on the debt limit.

Bitcoin meanwhile has been known to thrive under conditions of unpredictability and global economic uncertainty.

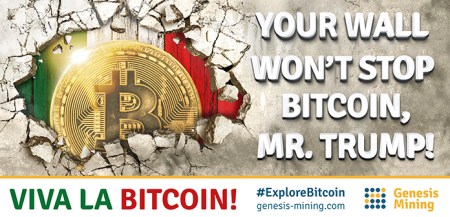

No More Bricks in the Wall

Trump’s classic threat of walling in Mexico with a physical barrier he would make it pay for is already looking less and less watertight thanks to borderless currencies.

As Mexico’s currency takes a continued beating following a major drop on election day, November 8, interest in Bitcoin and trading is growing fast.

As is being witnessed in countries such as Argentina and Venezuela, citizens are actively looking for a safe haven for their capital, which will be safe from geopolitical posturing. In Bitcoin, they have flexibility combined with increasing practicality as a day-to-day currency (although, as we have seen, it is by no means there yet).

What YOU Can Do For Your Country…

While Trump has still made no official comments about Bitcoin or its status under his rule, the community is already hitting the ground running with a concerted petition efforts.

In the meantime, for those who can’t wait until the inauguration, here’s something to hold you over while looking stylish at the same time:

Will Trump’s presidency boost Bitcoin into the mainstream? Let us know in the comments below!

Images courtesy of genesis-mining.com, mulvaney.house.gov, shutterstock, btcc.com