Bitcoin continues its dramatic price surge after incoming US President Donald Trump made a few crypto-friendly picks for his next cabinet.

Bitcoin Breaks Past $100K

Hours after announcing that he’ll likely nominate Paul Atkins for the Securities and Exchange Commission (SEC) post with current chair Gary Gensler stepping down on inauguration day, Bitcoin makes another move, finally breaching the $100k mark. And this excitement over the world’s top crypto has spilled to altcoins.

Bitcoin breaking the $100k barrier today. Source: Coingecko

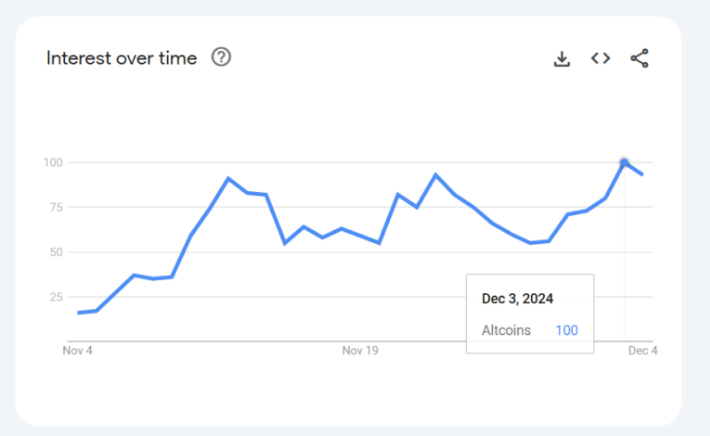

According to Google Trends, interest in “altcoins” spiked dramatically last November 30th, hitting 100, backed by a post-election frenzy and the appointment of crypto-friendly personalities. On December 4th, it hit 88 out of 100, matching the enthusiasm of the altcoin season 2021.

Altcoin Searches Started To Surge In November

Interest in altcoins and Bitcoin started to grow in November in anticipation of a second Trump administration. The public’s excitement is reflected on Google Trends, with searches for altcoins hitting 93 in November before declining to 56 in the second week.

Searches for "altcoins" up from Nov 4 to Dec 4. Source: Google Trends

An increasing search volume has traditionally been attributed to retail investors’ participation, the industry’s main driver of price surges. Today’s attention on altcoins is comparable to the bull cycle of 2016/17. Market observers say that this cycle of interest in popular altcoins happens when Bitcoin’s price is stable or new highs are being tested.

Aside from a spike in interest, some altcoins have registered substantial gains. For example, XLM and XRP’s prices have quadrupled this December but are still down from all-time highs. On the other hand, Tron (TRX) and Binance Coin (BNB) have hit new highs, suggesting increased market attention.

Favorable Altcoin Season Indicators

Market analysts and commentators are now paying attention to trends and other indicators to gauge the market mood. Jamie Coutts, the Chief Crypto Analyst of Real Vision, shared that the recent Bitcoin price performance isn’t the only best indicator of a potential altcoin surge.

Coutts added that the number of tokens trading offers a better understanding of the altcoin market. The Real Vision analyst also relies on the Altseason Indicator, which has a current score of 67% and suggests a consolidation phase for altcoins.

Folks, Altseason isn’t determined by the #Bitcoin dominance chart—it’s all about market breadth, like the number of assets outperforming $BTC.

In my view, when my Altseason Indicator crosses above 50% and the market is trending upward, that’s Altseason. Right now, the indicator… pic.twitter.com/ZsFGHTjpFK

— Jamie Coutts CMT (@Jamie1Coutts) December 2, 2024

CryptoQuant’s CEO Sees Spike In Trading Volume

Meanwhile, Ki Young Ju of CryptoQuant also shared his thoughts on the recent price action, saying that transferring assets from BTC to altcoins is no longer the main driver of the market. Instead, he cited the increase in trading volume for stablecoins and their market pairs as true drivers.

Young argued that the increase in stablecoin trading volume explains the current movement of altcoins. If there’s an increase in altcoin trading volume, it also means that use cases are expanding.

Featured image from NullTX, chart from TradingView