On-chain data shows that Bitcoin transactions going out of exchanges have been greater than the number of them going in since the FTX collapse.

Bitcoin Exchange Withdrawals Have Been Above Deposits Recently

As pointed out by an analyst on Twitter, BTC exchange deposits have been heading down in recent months. There are a few relevant indicators here; the first is the “exchange withdrawals,” which measures the total number of transfers that are going out of centralized exchange wallets.

The second metric is the “exchange deposits,” which, as is already obvious from the name, simply tells us about the number of the opposite type of transactions that are taking place in the market.

Exchange transactions can provide a hint about investor behavior in the market as holders usually use these platforms for selling and buying purposes. Deposits are usually done for distribution, while withdrawals may be done for accumulation-related purposes.

When these exchange transaction metrics are at elevated values, it means the investors are likely actively trading the cryptocurrency right now.

Another indicator is the “transaction count,” which measures the total amount of Bitcoin transfers that are taking place anywhere on the network. This metric naturally gives insight into whether the blockchain is getting high use by users or not at the moment.

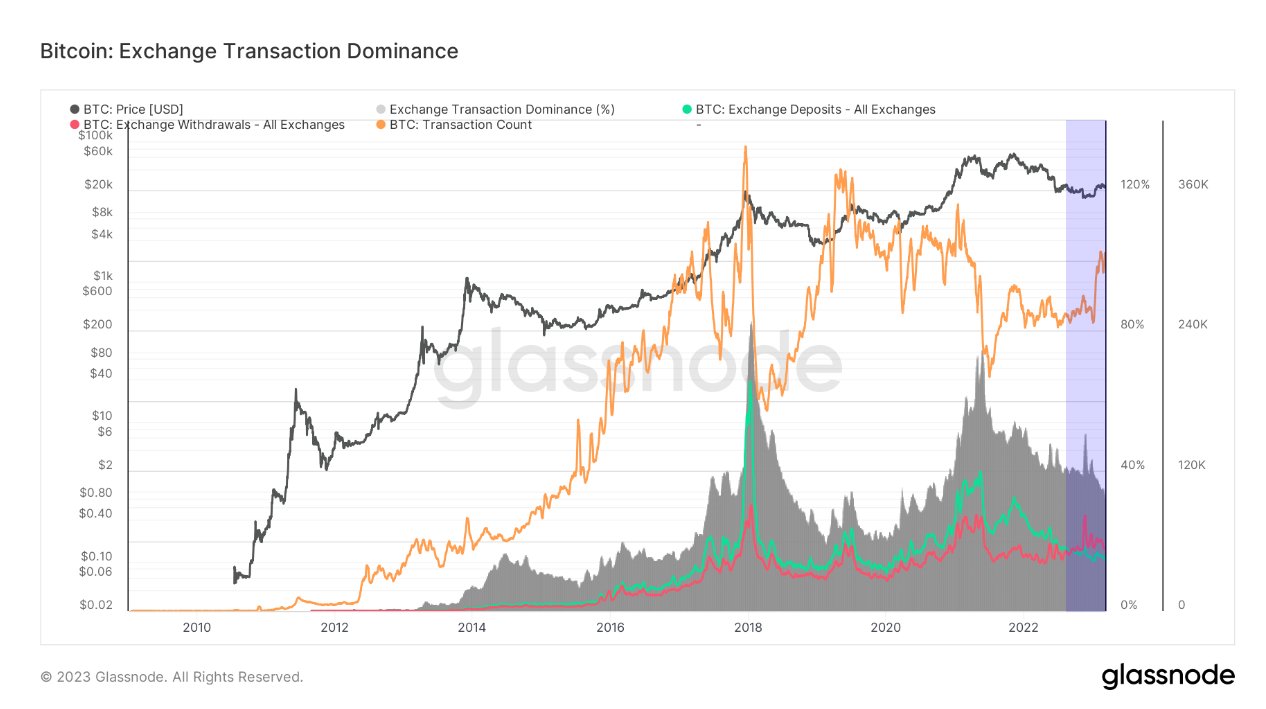

Now, here is a chart that shows the trend in these Bitcoin indicators over the entire history of the cryptocurrency:

The trends in the transaction count, exchange withdrawals and exchange deposits | Source: Jimmy V. Straten on Twitter

As shown in the above graph, the Bitcoin exchange depositing transactions have been riding a downtrend since the bear market started. This isn’t unusual and was also witnessed during the last bear market (2018-2019).

The reason behind why this trend may be observed is that the appetite for trading and especially selling goes down as a bear market runs its course and leaves traders exhausted.

In these last few months, however, a special trend has appeared in the Bitcoin market that has never been seen during the cryptocurrency’s history before. It’s the fact that the exchange withdrawals have overtaken the deposits now.

In the past, the withdrawals always used to stay below the deposits. A contributing factor behind this may have been that miners produce fresh Bitcoin outside of exchanges and then make deposits for selling it, thus unbalancing the transactions.

Since the FTX crash back in November 2022, however, this structure appears to have flipped. The collapse of a platform like FTX renewed fear among investors regarding keeping their coins in centralized custody. So, a large number of holders made the decision to withdraw their funds to keep them in self-custodial wallets, thus leading to the withdrawal transactions observing an unnatural boost.

The Bitcoin withdrawals have remained higher than the deposits into these initial months of 2023, but the gap has been closing recently. It now remains to be seen whether the market structure returns to how it used to be before, or if this is the new norm.

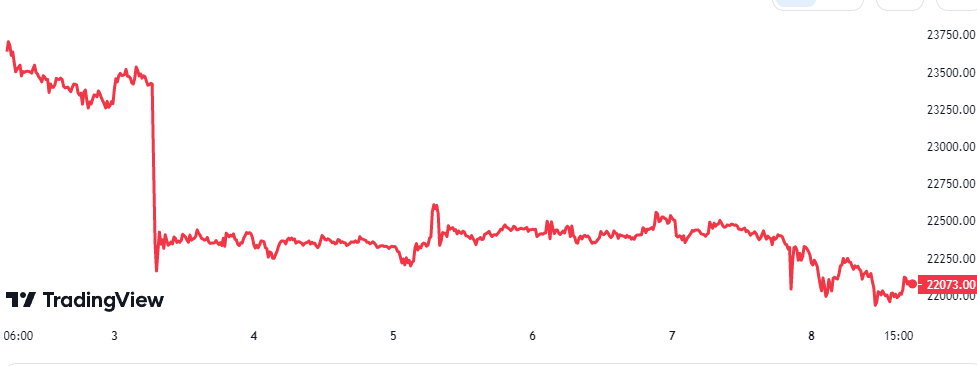

BTC Price

At the time of writing, Bitcoin is trading around $22,000, down 7% in the last week.

Looks like BTC has consolidated sideways recently | Source: BTCUSD on TradingView