Bitcoin has witnessed a plunge under the $51,000 level during the past day, here’s what’s potentially behind this decline according to on-chain data.

Bitcoin Has Slipped Under The $51,000 Level During The Past Day

Yesterday, Bitcoin had observed a sharp surge to touch the $53,000 level and set a new high for the year, but the rally was short-lived, as the cryptocurrency soon followed up with a sharp plunge all the way down to under the $51,000 mark.

Shortly after this plummet, though, the coin quickly rebounded back above $52,000, giving investors hope that the the drop was perhaps only temporary. Since then, however, the asset has once again seen a drawdown towards the same lows, as the below chart shows.

BTC has gone down a net amount in the past day | Source: BTCUSD on TradingView

Due to these red returns, Ethereum has managed to outperform Bitcoin on both the daily and weekly timeframes (ETH is even in 5% profits for the latter period). The altcoins, though, have still performed notably worse than the original cryptocurrency.

Now, what’s driving this decline for the asset? There are likely to be many factors involved, but one such major reason could lie in this on-chain development.

BTC Whales Have Participated In A Large Selloff Recently

As pointed out by analyst Ali in a post on X, the BTC whales have sold big recently. The “whales” are defined as entities on the network that are holding between 1,000 and 10,000 BTC.

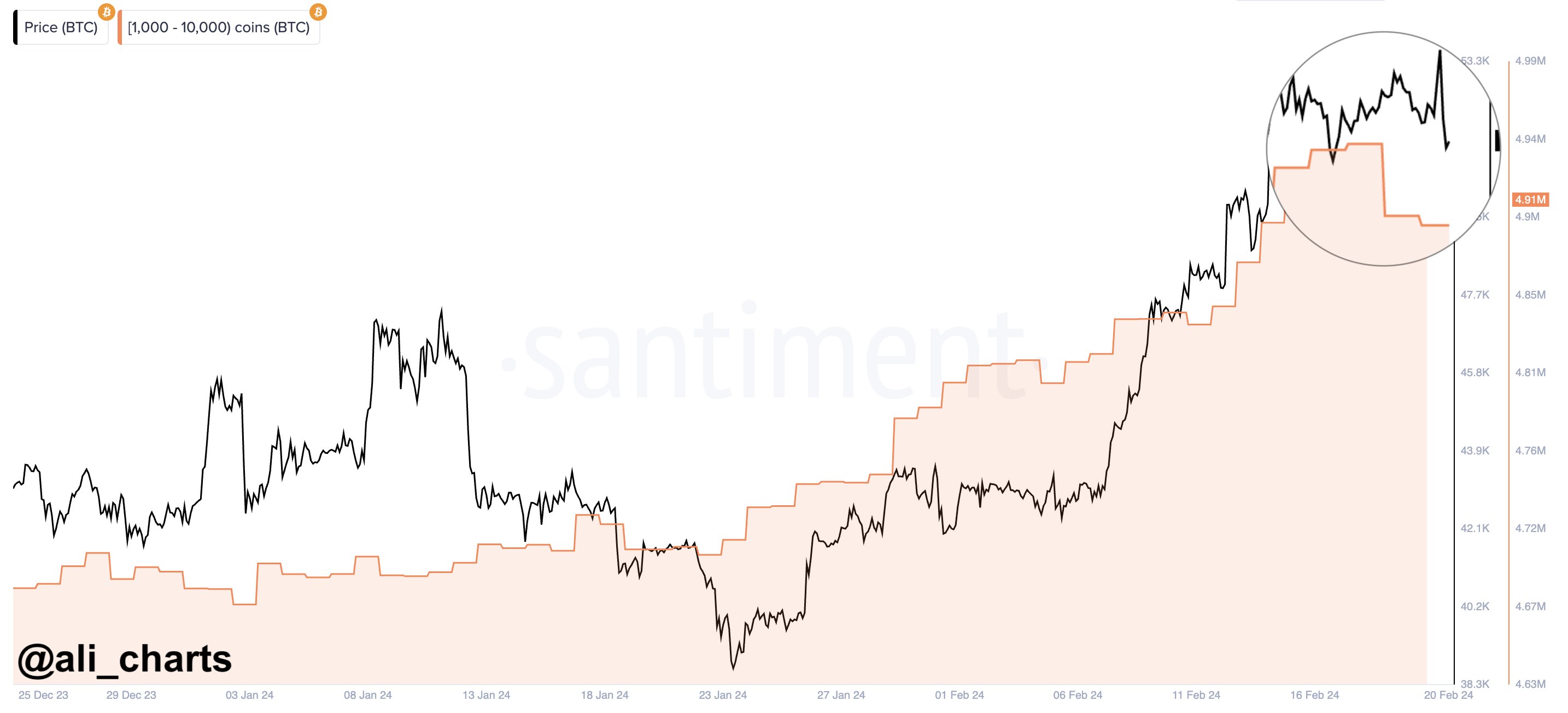

Since their holdings are so large, the whales can be influential beings in the market, and as such, their movements can be worth tracking. The below chart shows the trend in the combined holdings of these humongous Bitcoin investors over the past couple of months:

The value of the metric seems to have gone down in recent days | Source: @ali_charts on X

From the graph, it’s visible that the holdings of the Bitcoin whales had been on the rise since the start of the year, until a couple of days back, where the metric’s value turned around.

This would suggest that these humongous investors had been accumulating throughout the rally that eventually ended up taking the coin above $52,000, but now it seems these investors have finally decided to take some profits.

In this selloff, the Bitcoin whales have shed a total of 30,000 BTC from their holdings, worth more than $1.53 billion at the current exchange rate of the cryptocurrency.

This is a significant amount, so it’s possible that this selling pressure may at least partially be behind the latest drawdown that BTC has observed. It should be noted, though, that not all whales that accumulated recently have sold yet, as the holdings are still notably above the January levels.

It now remains to be seen whether the other whales would follow in the lead of these sellers and claim their profits, or if they will continue to hold strong, believing that Bitcoin would eventually turn itself around.