Bitcoin’s improving fundamentals and the arrival of institutional investors could impact the volatility and price action of future rallies and corrections.

The Nature of Bitcoin Rallies will Change

Aaron Brown, the author of a recently published op-ed in Bloomberg, believes that the next sustained Bitcoin rally could be more measured as it will be propelled by fundamentals and global financial events rather than FOMO.

According to Brown, the boom and bust nature of the cryptocurrency market is not likely to change immediately and if future price action mirrors previous bull markets then Bitcoin could rise to $60,000 to $400,000 before declining sharply.

Brown argues that the last two rallies in 2013 and 2017 were primarily driven by retail investors and that 2019 is different as the current $260 billion cryptocurrency market cap is much larger than it was in 2013 ($1 billion) and 2015 ($3 billion).

Furthermore, today there are significantly more cryptocurrency investors and in 2018 more than $30 billion of institutional and investment capital went toward building new platforms.

There is also more clarity on the regulatory front and with major institutions like Facebook, Goldman Sachs, JPMorgan Chase, and Fidelity investing in the sector, Bitcoin’s price action could be more measured in 2019.

Though the overall landscape appears robust, Brown cautions that this does not negate the possibility of a bubble and crash but as the sector matures so does the possibility of the market providing ‘predictable’ returns with the occasional 20% correction instead of the drastic 85% corrections which typically take place at the end of Bitcoin’s bull cycles.

Bitcoin Options Contracts Provide Valuable Insight

Looking into Bitcoin options data provides a little foresight into how Bitcoin price [coin_price] action could differ in 2019. In November 2017 Bitcoin contracts traded with an implied volatility above 300% and investors believed there was a 25% chance that Bitcoin could gain above $10,000.

Currently, BTC is nearly the same price it was around November 2017 and the same contract sells at approximately an 85% implied volatility which means there is a 15% chance of Bitcoin overtaking $10,000 in a month.

Accordingly, if Bitcoin reaches $10,000 then the expected high is around $11,000 and if it does not then the expected price is around $7,500. While this is a risky bet, it pales in comparison to the risk investors took on in 2017.

Market Correlations Matter

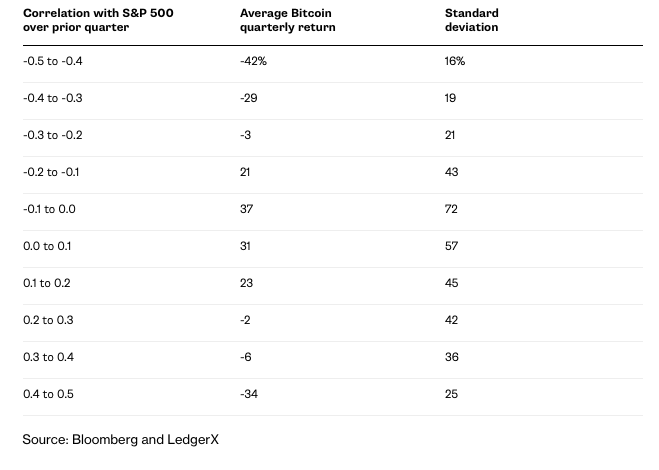

Bitcoin’s correlation to the S&P 500 Index also provides some guidance on 2019 price action. When the correlation is closer to zero for a quarter, Bitcoin tends to average high returns in the following quarter but volatility also increases.

On the other hand, when Bitcoin responds to market fundamentals, regardless of the correlation, the average returns tend to be lower or even negative.

As shown by the chart above, Bitcoin’s current correlation with the S&P 500 is near -0.2 and this is an area where volatility has not reached extremes in the past. Brown also pointed out that since mid-2018 Bitcoin’s correlation to the S&P 500 only hovered near zero for a couple of months in the first few months of 2019 whereas the correlations were near zero from September 2017 to January 2018.

According to Brown, Bitcoin appears to flip between positive and negative correlations with the S&P500 and intense price increases tend to occur when the correlation is near zero.

For this reason, Brown believes that the upcoming cycle could be different and he expects that over the summer prices will react to news about market fundamentals instead of FOMO.

What do you think about Aaron Brown’s theory? Share your thoughts in the comments below!

Images via Shutterstock, Coveware.com