Bitcoin price has very clearly created a rising wedge as short-term price action tests the 0.5 fib level between $13,000 and $14,000 twice over the last 20 Days. The question remains as to whether the strength of the current bullish trend will be enough to propel price levels upwards out of the current rising wedge, which is notoriously one of the most reliable bearish trading patterns. See here for more information on where BTC’s price could be heading for the remainder of 2019.

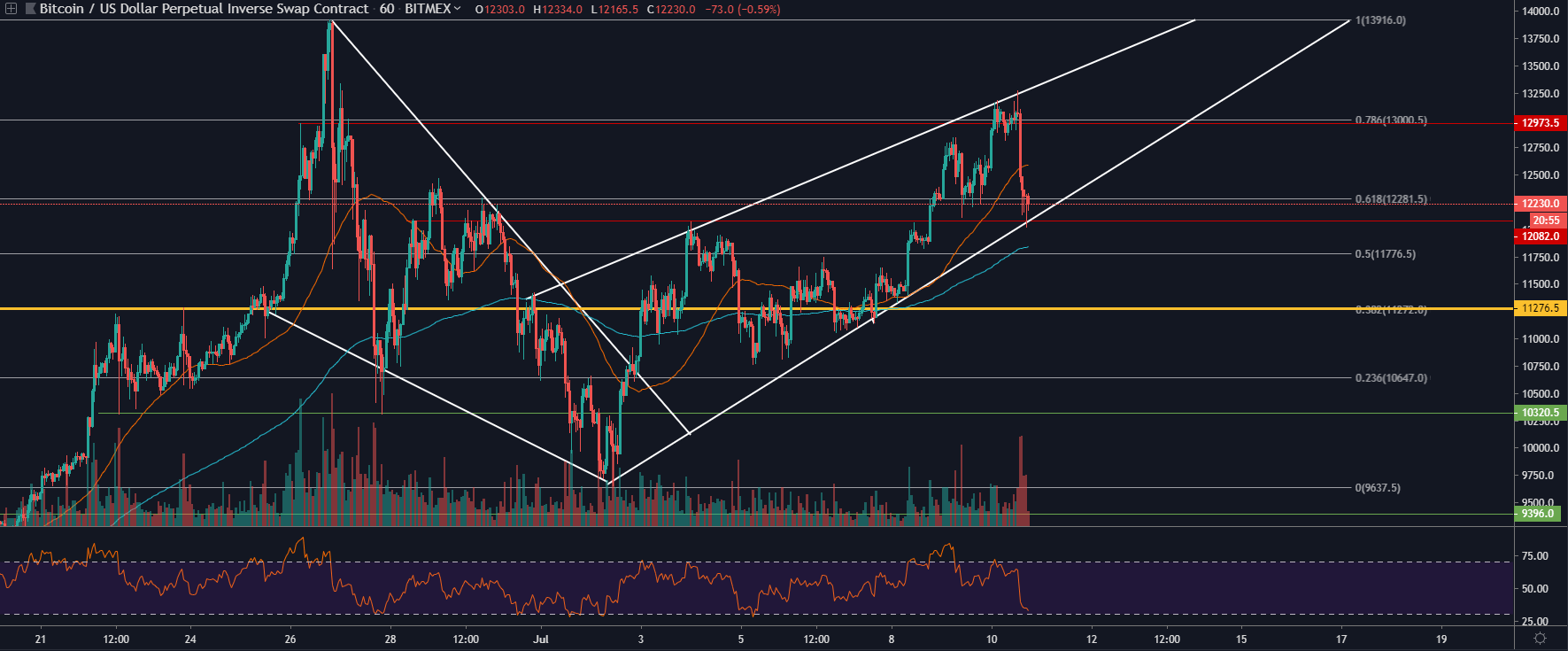

Bitcoin Price 1 Hour Analysis

On the 1 Hour chart, we can clearly see the most recent sell-off within the rising wedge pattern over the last few hours. During this time RSI has turned oversold indicating bears are in control of the intra-minute price action. However, despite this, the current short-term trend is still very much bullish. Clear red volume supports the most recent sell-off, however price action is still within the rising wedge and could bounce very soon.

On the 1 Hour chart, we can clearly see the most recent sell-off within the rising wedge pattern over the last few hours. During this time RSI has turned oversold indicating bears are in control of the intra-minute price action. However, despite this, the current short-term trend is still very much bullish. Clear red volume supports the most recent sell-off, however price action is still within the rising wedge and could bounce very soon.

Key support levels to look out for if price levels break-down from the rising wedge are $11,750, $11,275, $10,700, $10,300, and $9,300. These are sensible levels to re-enter or take profit on shorts if you catch the break-down. It’s likely price levels will re-visit POC around $11,275 before carrying on the bullish uptrend as stated in my previous Bitcoin price analysis.

The order books are very thin above the current market price of $12,067 meaning there’s very little resistance in terms of resting orders in the market in comparison to the current level of volume that is being traded from day to day on Bitcoin. This is a strong indication that further upside is to come well above $14,000 and also means the price action will move quickly presenting lots of opportunities for leverage traders in the market.

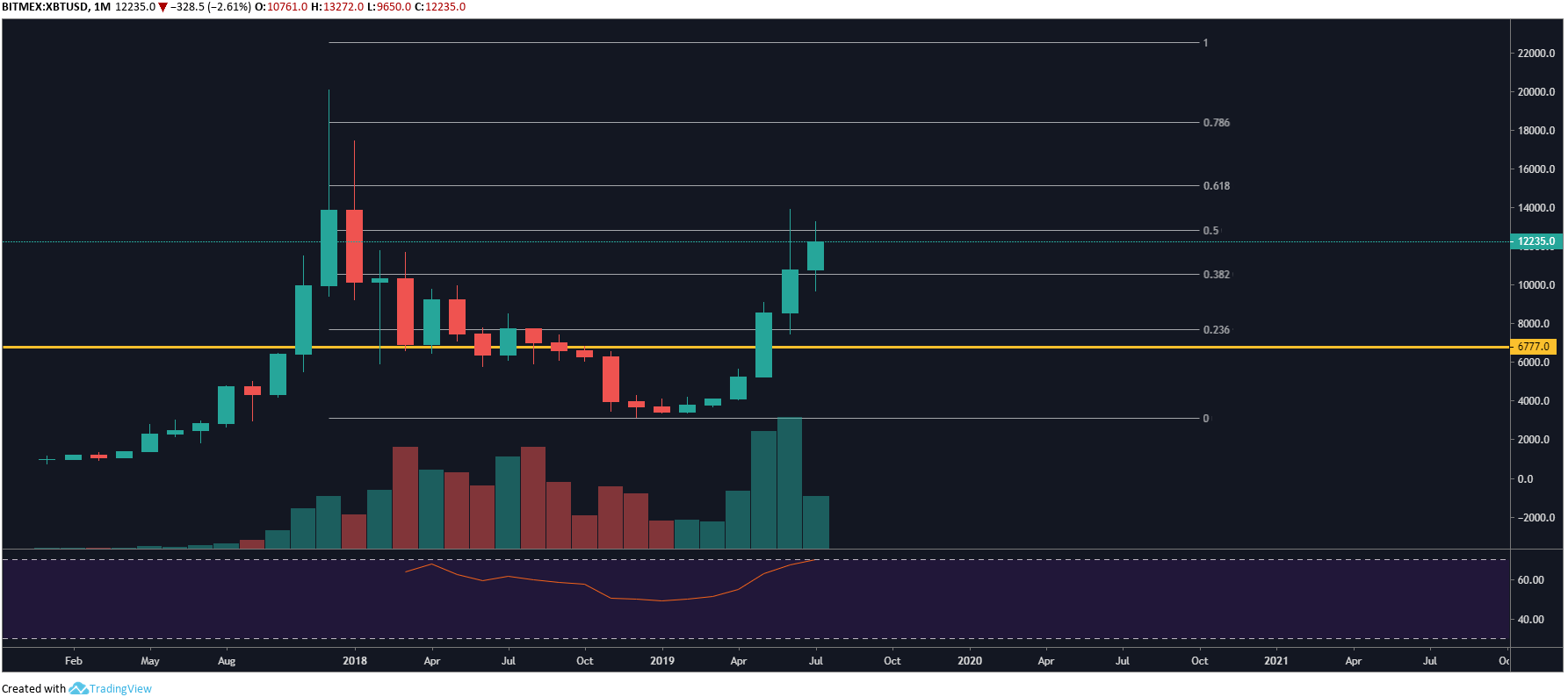

BTC 1 Month Analysis

On the 1 Month chart, we can see the RSI (Relative Strength Index) indicator is oversold clearly showing bulls are in control of the current trend. POC (Point of Control) has yet to move up from $6,7770. If BTC was to see a huge re-trace which is increasingly likely when you look back at previous bull runs, there’s always been a 40%+move to the downside before new ATH’s have been hit, then POC would be the best point in which to consider scaling back into BTC.

Price levels are currently jammed between the 0.382 and 0.5 fib which is typically a zone where price levels like to consolidate and move sideways, which we have yet to see on BTC. This could be an indication that the rising wedge on the hourly chart could break resulting in consolidation or sideways movement between these price points of $11,200 and $13,000. This would allow altcoins a much-needed breather, allowing them to bounce from their all-time lows, this would also likely see the overall cryptocurrency market-cap surpass the currently yearly highs of $350B.

Do you think Bitcoin price will ever return back to the monthly POC (Point of Control) at $6,7770? Please leave your thoughts in the comments below!

Images via Shutterstock, Tradingview