Decentralized finance, or DeFi, has come a long way this year. Bitcoin has also made a remarkable recovery from the depths of crypto winter this time a year ago. But which one would be better for long term gains?

BITCOIN vs DEFI

For the uninitiated DeFi is the system of staking crypto collateral in a decentralized smart contract governed lending network. It is a completely new way of approaching finance in a world where the current banking system is clearly crumbling.

A number of platforms have emerged and 2019 has seen explosive growth in the amount staked and the returns rewarded. Ethereum is the platform of choice for DeFi and Maker has the market cornered with over half of all assets locked in.

TokenAnalyst has taken a look at gains so far this year for both bitcoin and DeFi platforms. With $1,000 invested on January 1st, BTC would have yielded gains of 133% while hodling ETH would have made just 36%. DeFi platforms have offered considerably less.

If you had $1000 on Jan 1st 2019 and:

– Invested in $BTC, you'd have $2,333 (+133%)

– Invested in $ETH, you'd have $1,364 (+36%)

– Lent on @dydxdigital, you'd have $1,060 (+6%)

– Lent on @compoundfinance, you'd have $1051 (+5%)

– Lent on @UniswapExchange, you'd have $1219 (+22%) pic.twitter.com/0wPty1Nv6J— TokenAnalyst (@thetokenanalyst) November 13, 2019

RISK vs REWARD

The thing to note here is that bitcoin is highly speculative and extremely volatile. Therefore the investment risk is substantially higher, but so is the reward. DeFi platforms are not designed to be high risk investment vehicles, they are designed to replace banks offering greater returns, and for that they have succeeded.

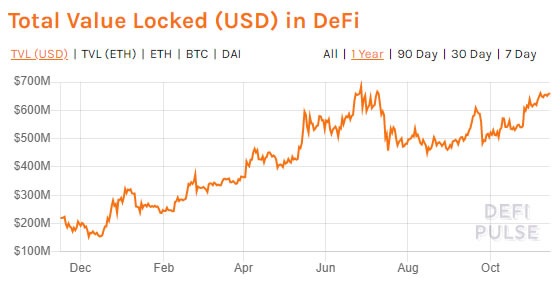

Bitcoin has been around for a decade while DeFi is still in its first real year of growth. Since the beginning of the year the amount invested in DeFi has grown by 140% according to defipulse.com. So taking those figures the decentralized finance ecosystem has grown more than bitcoin has this year.

There is currently $660 million locked in DeFi platforms and a record volume of ETH at 3.5 million. As the world plunges deeper into debt and interest rates fall into negative territory, people are going to be looking for alternative forms of investment.

Locking digital assets up in a secure DeFi smart contract typically yields between 5 and 20 percent. Considering that Ethereum is the backbone for the entire ecosystem at the moment, further growth will also result in greater demand for ETH so earnings could be twofold.

Bitcoin will always be viewed as the store of value, or digital gold, while Ethereum and DeFi appear to be shaping up as the future of decentralized internet money. The world is on the cusp of a massive paradigm shift when it comes to financial systems and the future clearly needs to be decentralized, as the current system is clearly flawed.

Will DeFi continue to grow as the banking system collapses? Add your thoughts below.

Images via Shutterstock, Twitter @thetokenanalyst, chart by Defi Pulse