Decentralized finance, or DeFi, has quickly become one of the most rapidly growing industries in the blockchain space — with a vast array of novel DeFi platforms and technologies appearing each month.

As an umbrella term used to describe the wide range of blockchain-based tools and protocols used to carry out financial transactions, DeFi is quickly growing in scope, as increasingly creative applications continue to push the boundaries of how users can gain utility from their digital assets.

But the bulk of this development has occurred on the Ethereum blockchain — largely thanks to its first-mover advantage. More recently, however, developers have begun turning their attention to Binance Smart Chain (BSC), due to a number of technical advantages that some argue make it better suited to DeFi applications.

While DeFi on BSC is still somewhat in its early stages, the main infrastructure is now beginning to appear — potentially setting the stage for big things to come on the network.

NFTs Are Coming to BSC

Widely considered to be one of the most promising digital asset classes, non-fungible tokens (NFTs) have begun picking up significant momentum in recent months — with NFT trading volumes reaching record highs, and more than a few blockbuster NFT sales occurring in the last few months.

Moreover, with major brands like Pizza Hut, Taco Bell, Ubisoft, Nike, and Formula 1 beginning to throw their hat into the ring, NFTs are becoming increasingly recognized as attractive investments and functional tools.

However, until only recently, the vast majority of interest surrounding NFTs was concentrated on the Ethereum blockchain — since it was the first platform to feature an NFT marketplace and widely used non-fungible token standards like ERC-721 and ERC-1155.

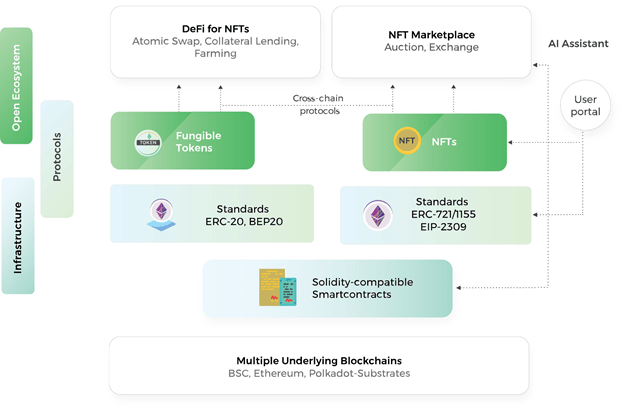

But with the advent of Spores Network — a full suite NFT cross DeFi ecosystem — Binance Smart Chain is about to get the NFT treatment. The platform is centered around making NFTs not only more accessible, but also more useful, by providing a range of powerful tools NFT enthusiasts can use to create, sell, manage, and use their tokens.

Image courtesy: spores.app

Beyond this, Spores goes one step further and looks to produce an NFT-DeFi ecosystem on Binance Smart Chain — by seamlessly combining an NFT marketplace with a decentralized exchange (DEX) platform. This accomplishes a few main things, such as helping NFT creators, artists, and sellers more easily source liquidity for their assets, while also enabling NFTs to be used through the broader BSC DeFi landscape.

With Spores set to launch its marketplace beta, cross-chain NFTs, and DeFi capabilities in Q3 2021, Binance Smart Chain is just weeks away from seeing the beginnings of its NFT landscape.

Decentralized Options Are Almost Here

Decentralized trading platforms have long been recognized as the cornerstone of any fully-fledged DeFi ecosystem. After all, trading, hedging, and speculation are some of the most popular use cases for cryptocurrencies today.

Until recently, the vast majority of cryptocurrency trading on Binance Smart Chain occurred on decentralized automated market maker (AMM) platforms like PancakeSwap. However, these provide only limited control over orders, making them poorly suited for advanced trading strategies and trading on the downside.

For this reason, decentralized options trading platforms have long been seen as the holy grail for traders, since they allow users to speculate on the direction of the market and hedge their positions using highly flexible derivatives contracts known as options. But while the decentralized options space on Ethereum is currently dominated by heavy hitters like Premia and Hegic, Binance Smart Chain has lagged behind in this regard until very recently.

Delta.theta, an upcoming options trading platform on Binance Smart Chain, will become one of the first projects to begin building out BSC’s derivatives scene. The platform is designed to cater to traders by allowing them to easily trade call and put options for a range of assets through its decentralized trading terminal — providing a great deal of control over orders.

But more than this, in true DeFi fashion, delta.theta has also launched a lite version of its options trading platform — specifically geared towards yield farmers. The platform provides a simple dashboard farmers can use to protect the downside of their investments (among other things) — helping to maximize their capital efficiency and execute otherwise advanced trading strategies with ease.

Community, hello👋

Incentivized testnet is still on, we have a lot of active users who test the platform, a lot of bugs found, and of course there will be many rewards for the best of you to help in the testing!😉

👉 https://t.co/7apy46vdZi#DeltaTheta #OptionsTrading $DLTA pic.twitter.com/BtBqsEQlcK— DeltaTheta (@deltatheta_tech) June 5, 2021

The platform is still operating its incentivized testnet but is set to move to its mainnet on BSC in Q2 2021.

With decentralized derivatives widely acknowledged to be a crucial pillar of decentralized financial infrastructure, platforms like this are beginning to lay the foundations for derivatives trading on BSC. And with the low fees, high throughput and minimal latency the BSC blockchain provides, it may not be long until it becomes the platform of choice for both retail and institutional traders.