Ethereum is expected to move much higher in the months ahead as the leading cryptocurrency prints a bullish technical signal.

Ethereum Bounces Cleanly Off $390 Horizontal Region in Bullish Move

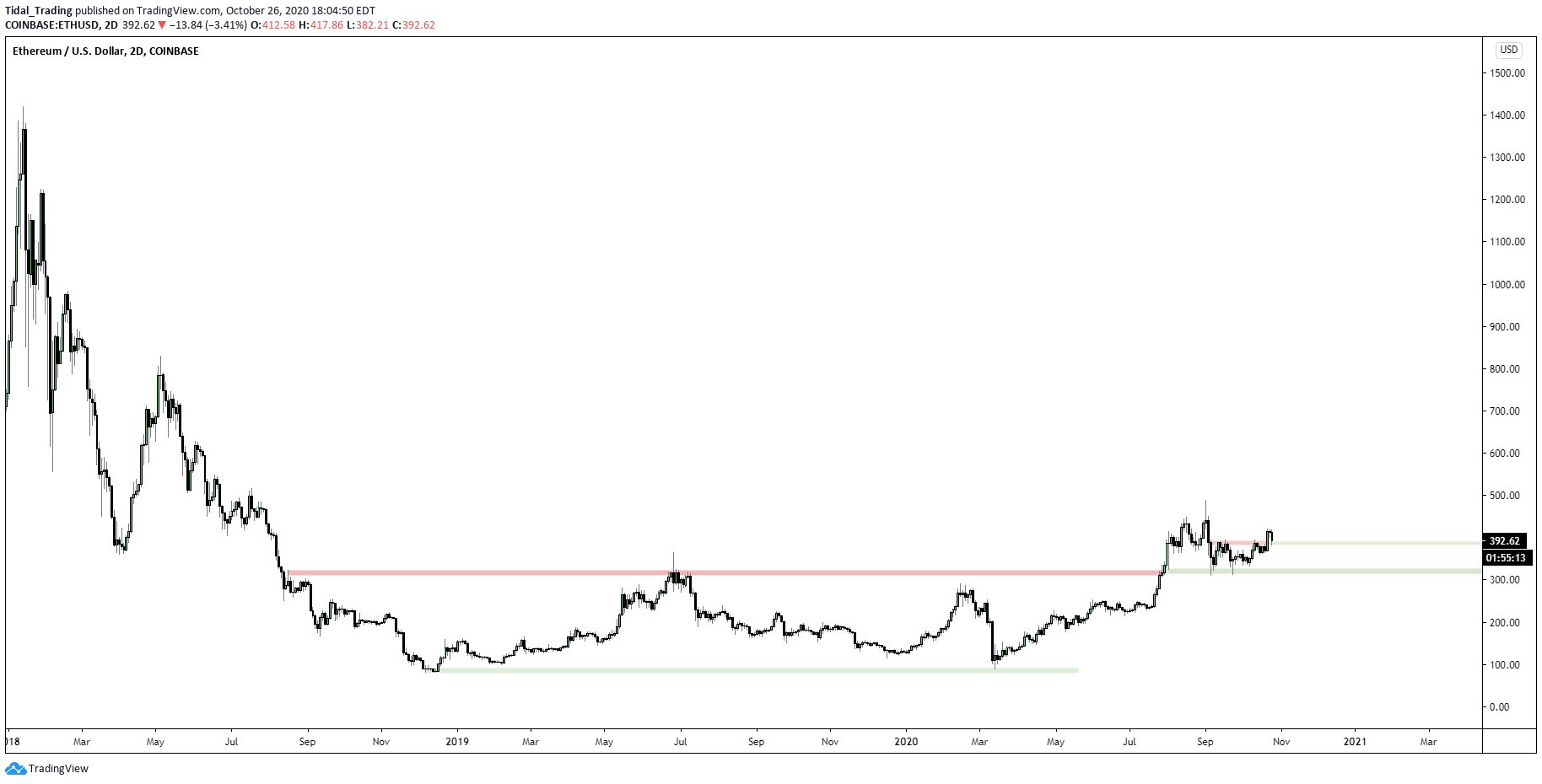

As the chart shared below shows, ETH recently bounced off the $380-390 horizontal region, which marks a win for bulls. The chart shows that over the past few months and even stretching into 2018, the high-$300s were an important level for Ethereum to hold.

The coin managing to do so now bodes well for the bull case.

Chart of ETH's price action since the start of 2018 with analysis by crypto trader Hornhairs (@Cryptohornhairs on Twitter). Source: ETHUSD from TradingView.com

Not the Only One That Thinks So

The aforementioned analyst isn’t the only one that thinks Ethereum will undergo a strong long-term rally.

Leading Binance futures trader Logan Han shared the chart seen below earlier this month. It shows that Ethereum could see a macro rally towards $800 in the coming months as it undergoes an important bullish breakout from a descending triangle/wedge pattern.

This chart was shared shortly after he pointed out that ETH’s price action now looks similar to that seen prior to 2017’s exponential rally. That rally took the coin from the $300 region to highs of $1,400 in the span of a month.

Chart of ETH's price action since the miiddle of 2018 with an analysis by crypto analyst and top Binance trader Logan Han (@LohanHan_ on Twitter). Source: ETHUSD from TradingView.com

Value Accrual Mechanisms to Drive ETH Higher

Ethereum has long-term value accrual mechanisms that may drive the cryptocurrency higher.

For one, Ethereum Improvement Proposal 1559 is expected to be rolled out in the coming months or year. Analysts see this investment as pivotal for ETH’s value accrual mechanism:

“The purpose of EIP 1559, according to Eric Conner, is to provide wallets and users a much needed improvement to the user-experience of gas management. The way that EIP 1559 solves the gas-management problem also improves Ethereum’s monetary management system.”

Estimates suggest that if EIP-1559 was activated over the past 12 months, nearly one million ETH would have been burned.

ETH's 3 value accrual pillars:

– Trustless SoV ✅

– EIP-1559 (fee burning) ⏲️

– Staking ⏲️Which leads to:

– Trustless economy (DeFi)

– Deflationary ETH

– In-protocol ETH yieldWe've only got 1 out of 3 currently but ETH has a market cap of $46bil.

Imagine when ETH has 3/3.

— sassal.eth/acc 🦇🔊 (@sassal0x) October 24, 2020

ETH2 is also expected to be activated in the near future. ETH2 will give Ethereum a natural staking premium where those looking to earn yields may buy ETH, then stake it to earn a passive income.

Photo by Byron Johnson on Unsplash Price tags: ethusd, ethbtc Charts from TradingView.com Ethereum Prints Pivotal Bullish Signal as It Holds $390 Region