Ethereum has stalled after hitting the pivotal highs of $420 earlier this week. The coin now trades for $408, failing to break higher even as Bitcoin flirts with yet another breakout ahead of the weekly close.

Despite the mixed price action, analysts think ETH remains in bullish standing.

Ethereum Analysts Thinks the Uptrend Is Intact

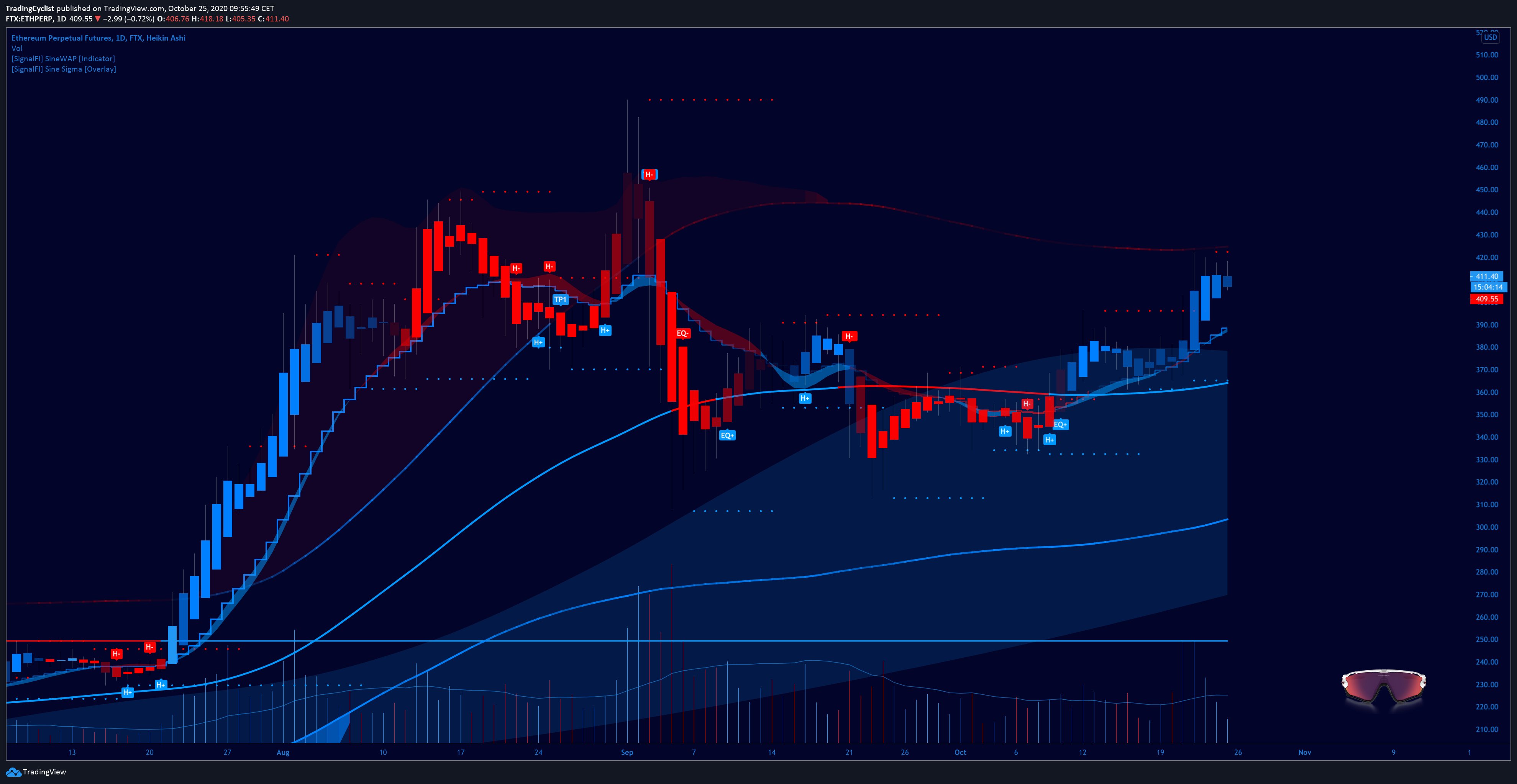

One crypto-asset analyst shared the chart below on October 25th. It shows that Ethereum remains in a consolidation below a pivot level. Even still, the uptrend still seems to be intact as ETH holds the $400 support region:

“We got the move everyone wanted. Now price meets resistance of Sine upper band. Today’s candle shows already a small lower shadow. Some retest around 396/400 might be necessary to break above the band like end of July, but uptrend on track!”

Chart of ETH's price action over the past few weeks with an analysis by crypto trader Trading Cyclist (@FullGasTrader on Twitter). Source: ETHUSD from TradingView.com

This was echoed by another analyst just recently as Bitcoinist reported previously. This other commentator noted that the coin is currently about to print another leg higher as it consolidates between $405 and $420.

Chart of ETH's price action over the past few weeks with an analysis by crypto trader Steve (@Thetradingtramp on Twitter). Source: ETHUSD from TradingView.com

ETH2 Blow Dealt

One of Ethereum’s crucial bullish fundamental catalysts may be put on hold for now, though.

As first reported by CoinDesk, Ethereum Foundation researcher Danny Ryan commented that the ETH2 deposit contract may be pushed back due to audits.

The deposit contract is the contract that will link the original Ethereum chain to the 2.0 chain, which will have staking enabled.

Commenting on the Bankless podcast, hosted by Ryan Sean Adams and David Hoffman, Ryan commented on the matter:

“This library is critical to creating keys, signing messages. Critical, in early phases, [means] that if you use this library, they need to be secure; if you use it to generate your wallets, it needs to have good randomness; and if you are signing your deposits which have a signature associated, it needs to be correct,” Ryan said. “Given that how critical this library is, and given that, if there is a fundamental error in this library we could f*ck some sh*t up in terms of genesis deposits, that is the blocker,” he said.

Other Ethereum researchers and developers think there will be a delay between the publishing of the deposit contract and the actual launch of the chain.

Featured Image from Shutterstock Price tags: ethusd, ethbtc Charts from TradingView.com Here's Why Analysts Think That Ethereum's Uptrend Remains on Track