Nvidia experienced a temporary inclusion into the distinguished league of companies valued at $1 trillion in terms of market capitalization as a result of the surging demand for artificial intelligence technology.

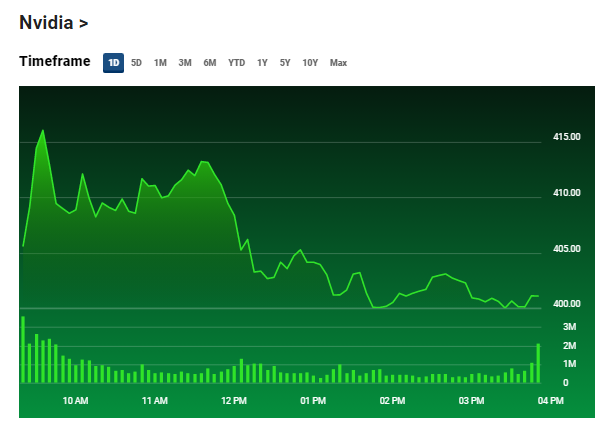

This significant achievement occurred on May 30 during morning trading hours in the United States, when the company’s shares, as reported by Google Finance, reached a peak of more than $418.

By the end of the day, Nvidia (NVDA) shares settled at slightly above $401, resulting in the company’s current market capitalization standing at $992 million.

Despite concerns about an overinflated market, Nvidia’s recent surge in stock price is seen by some as an indication that there is still ample opportunity for the company to expand, particularly with the belief that the artificial intelligence (AI) industry is just beginning to gain momentum.

Nvidia stock hitting $418. Source: FOX Business

Jim Kelleher, an analyst from Argus Research, noted that the combination of technical traders and the AI frenzy propelled Nvidia toward the $1 trillion market capitalization, albeit at a high valuation.

Nvidia has experienced an impressive year-to-date gain of more than 180% due to the surging demand for graphics processing units (GPUs) that power generative AI tools.

A recent Reuters report highlighted that Nvidia currently manufactures 80% of these GPUs, further solidifying its dominance in the market. In the United States, only four companies have surpassed the $1 trillion valuation mark: Amazon, Apple, Microsoft, and Alphabet, the parent company of Google.

Nvidia’s Computex 2023 Keynote Unveils AI Advancements

During the weekend, Nvidia made several significant announcements at its Computex 2023 keynote, showcasing the company’s advancements in the field of artificial intelligence (AI). One notable revelation was the demonstration of games utilizing Nvidia’s Avatar Cloud Engine (ACE) for Games, which supports natural language for both input and responses.

Furthermore, Nvidia introduced the DGX GH200 supercomputer, a cutting-edge system built around its latest Grace Hopper Superchip. This powerful supercomputer has the remarkable capability to deliver an exaflop of AI performance, signifying a significant leap forward in computational power for AI applications.

BTCUSD retreats into the $27K region. Chart: TradingView.com

The AI Boom

However, the company is not the only player in the race to bring AI-ready chips to the market. In April, it was reported that Elon Musk, the former CEO of Twitter, acquired thousands of general processing units (GPUs) for an upcoming AI project at Twitter. This move demonstrates the growing demand and competition in the AI chip space.

Similarly, Microsoft is actively working on developing its own AI chip. The chip is intended to power AI applications not only for Sam Altman’s artificial intelligence firm OpenAI but also for Microsoft’s internal projects.

These developments highlight the intensifying competition and the increasing emphasis on AI hardware capabilities. As the demand for AI continues to grow, companies like Nvidia, Twitter, and Microsoft are investing heavily in developing specialized chips to support and accelerate AI applications across various domains.

-Featured image from FOX Business