The sentiment surrounding Bitcoin to kick off 2021 was the highest it has ever been, with FOMO stretching from retail to corporations and institutions.

However, things are quickly taking a turn for the negative. Pouring salt in the sudden and fresh wound, the United States Securities and Exchange Commission just issued a warning to investors regarding the risk associated with the first ever cryptocurrency.

SEC Calls Bitcoin “Highly Speculative” In Investor Risk Warning

During the pandemic, the nascent technology of cryptocurrencies moved to the forefront of finance as traditional payment methods paused as the world stood still.

Physical coin shortages and a fear of touching cash pushed the all-digital asset class forward unlike ever before. It has led to digital coin shortages on exchanges like Coinbase Pro and elsewhere, as investor refuse to sell their BTC even at prices above $50,000.

Related Reading | Bitcoin Crushes Commodity And Metal ROI, But A Gold Comeback Is Due

Investors instead “HODL” because they speculate that the top cryptocurrency will reach $100,000 or more this year. But what if they’re wrong?

That’s just one of the factors the United States Securities and Exchange Commission warns of in a new letter issued. The Division of Investment Management arm of the SEC “strongly encourages” investors to carefully consider risk disclosure, “risk tolerance, and the possibility, as with all investing, of investor loss.”

They move on to say that any investments made into Bitcoin either through spot markets or through futures, is “highly speculative.” The statement, however, isn’t untrue.

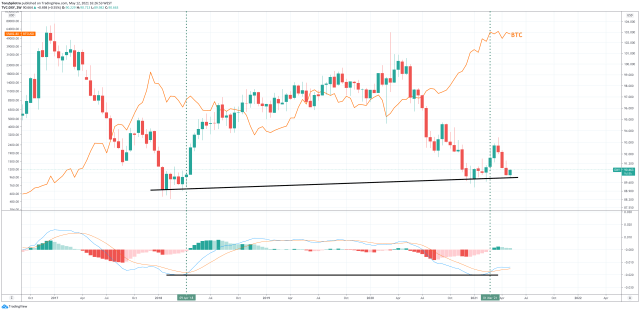

The dollar is starting to turn around as Bitcoin gets heavier due to sentiment change | Source: DXY on TradingView.com

The US Sets Sights On Crypto, Aims To Crash Markets, Quell Inflation Fears

There’s been a sudden shift in tone around the United States and other governments now that crypto has become so hot as an industry and inflation fears run out of control. Even the IRS is coming after Bitcoin investors in some way and are digging up transactions records to target early investors.

The price of lumber alone is a prime example of how the dollar’s slow-death has impacted markets in an unusual way. Equities and crypto are even more outrageous thanks to the success of ongoing stimulus efforts.

Related Reading | IRS To View Bitcoin Exchange Records, “Taxman” Is Coming “For Crypto”

The US government is now faced with a balancing act between propping up markets with stimulus money, and crashing markets to prevent stimulus money from inflating prices too much on goods and assets. But what happens when one side of the balancing beam teeters fully to one side?

Until that eventually happens, things could continue to whipsaw for some time as the Fed, and other agencies collaborate to keep the dollar afloat.

Featured image from iStockPhoto, Charts from TradingView.com