It’s Ethereum time to shine. The smart contracts pioneer is doing so well lately that the flippening narrative returned. With a vengeance. The flippening refers to the hypothetical time when ETH’s market capitalization surpasses that of BTC.

Will that ever happen? Can Ethereum dethrone Bitcoin and become the king of the crypto space? And if so, will it happen this cycle? Let’s explore the case further. We at Bitcoinist already covered the main reasons for Ethereum’s recent rise to prominence, which are:

On one hand, we have the rise of DeFi and the NFT craze. On the technical side, we have the EIP-1559 update coming in July. And on the corporate side, Visa settling transactions in USDC, the EIB’s €100M digital bond, and the release of CME Ethereum Futures.

And to that, we should add the three Ethereum ETFs recently approved in Canada. The institutional adoption seems to be following Bitcoin’s path. However, the king of crypto currently can’t compete with all of the other use cases and incredible developments taking place in the Ethereum landscape. The question is, should it? Does Bitcoin have to compete?

Related Reading | Gold Rebounds More Than 15% Against Bitcoin In Crypto “Hash Crash”

Is the flippening inevitable?

In a recent episode of the “Uncommon Core” podcast, Twitter-famous investor CryptoCobain told Su Zhu and Hasu:

I think the flippening is now inevitable, but I think it’ll be incredibly temporary. I think you’ll have a massive blow-off top, and ETH’s blow-off top will be slightly before or slightly after the Bitcoin blow-off top, and it’ll temporarily flippen. I’ve never felt more comfortable with a trade in my life. Not financial advice to your listeners. And the reason is that the total addressable market of things for Ethereum is just gigantic.

As for the reasons he thinks it’ll be temporary, CryptoCobain said, “In bear markets, Ethereum goes to zero but Bitcoin does pretty well.” Inspired by that interview, this Blockchaincenter analyst revisited his “Flippening Index,” which covers a few metrics other than just market capitalization:

"The Flippening is inevitable"

…is what @CryptoCobain said in the UCC Podcast with @hasufl and @zhusu .

Enough reason for me to remodel the Flippening Index: https://t.co/ZUQKxLEO0p pic.twitter.com/qcd5VnZjHk— Rohmeo (@rohmeo_de) April 29, 2021

There, we can see that Ethereum already surpassed Bitcoin in everything that has to do with number of transactions. Nevertheless, Bitcoin is way ahead in number of nodes and Google search interest. The exciting battle is taking place in trading volume and number of active addresses, though. The “Flippening Index” is a work in progress, so keep an eye on it.

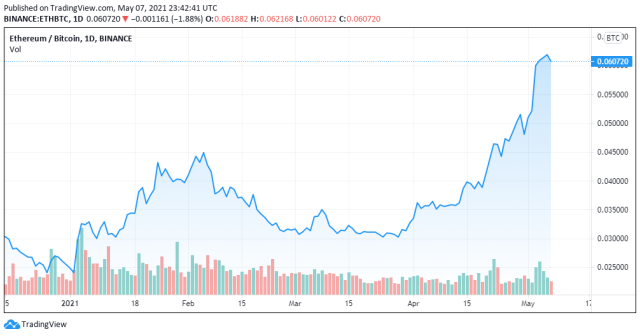

The relationship between ETH and BTC on Binance | Source: BTC/ETH on TradingView.com

The Flippening narrative in 2018

Before arriving at any conclusions, it’s always wise to check the history books. This is not the first time that the hypothetical event is widely discussed. And all of the predictions made in the past by Bitcoin bears haven’t aged well. They obviously weren’t counting on the king’s majestic resilience.

In 2018, Bitcoinist reported on the words of Roger Ver, the infamous father of Bitcoin Cash:

Ver states that Ethereum and Bitcoin Cash will experience significantly higher growths than Bitcoin in the coming months and years. He even goes as far as predicting that Ethereum will overtake Bitcoin before the year is out, with Bitcoin Cash taking center stage by 2020.

“I see it happening, and I believe it’s imminent. Ethereum could overtake Bitcoin by the end of the year, and Bitcoin Cash could do the same before 2020.”

Related Reading | Bitcoin Has Been in a Bull Run Since 2019—and There’s More to Come: Analyst

During the same year, CNBC reported on the words of Ethereum’s co-creator:

Steven Nerayoff says increased projects built on the cryptocurrency could trigger a “flippening” in 2018, in which ethereum overtakes bitcoin.

“What you’re seeing with ethereum is exponential increase in the number of projects — there are billions of dollars being poured into the ecosystem right now — maybe 10 times more projects this year than last year, which could easily lead to a doubling, probably a tripling in price by the end of the year.”

Evidently, the flippening didn’t happen at the time. Does that mean that it will not happen now? The main reason its proponents wield is that Ethereum has infinitely more use cases than Bitcoin, but, is that a sound argument? A swiss knife doesn’t inherently have a bigger market than a screwdriver. And, if taking out a screw is what you need to do, a screwdriver is the tool you want.

Featured Image by Austin Neill on Unsplash - Charts by TradingView