Friend.tech is one of the hottest things to happen in the crypto industry in the past two months. In the relatively short time of its existence, the decentralized social media app has been through ups and downs. From averaging trading fees rivaling top cryptocurrencies like Bitcoin and Tron, to being labeled dead just a few weeks after launch, to making a tremendous comeback to a new all-time high in terms of Total Value Locked (TVL), it has definitely been an eventful period for Friend.tech.

A recently released report by AMLBot, a platform that helps users check crypto wallets for illicit funds, has dived into the ins and outs of Friend.tech to explore whether the decentralized social media app is an investment opportunity to consider.

The Positive And Negative Aspects Of Friend.Tech

Built on Coinbase’s Base scaling network for Ethereum, Friend.tech’s social media app allows users to trade tokenized shares of other users’ profiles using ETH. According to AMLBot’s report, the business model is worth considering for investment. The app charges a 10% fee every time a user buys “keys” (previously known as shares) of another user, with 5% going to the account whose shares were bought. At the time of writing, Friend.tech has generated over $240.3 million in trading fees.

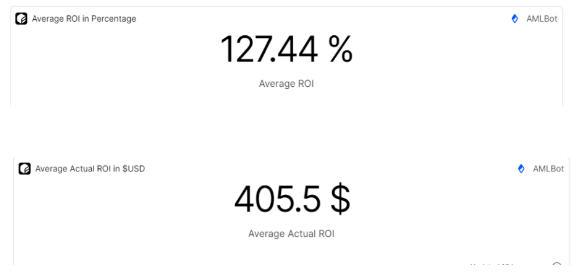

Friend.tech’s user base is very diverse, as demonstrated by the various degrees of wins and losses. AMLBot has shown that the average return on investment for users is 127.44% and $405.5 in US dollars, with the top users earning as much as $254,000. However, some users have also lost around $6.3 million, showing the potential downside.

What’s Next For Friend.tech?

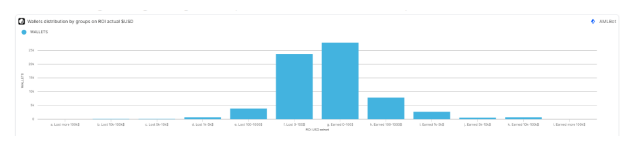

Profitability on Friend.tech generally depends on how users can bet on profile shares that can potentially turn a profit. Data has shown that the platform has actually turned a profit for the majority of its user base. A large number of wallets (27,800) have earned between $0-$100 on Friend.tech, and 684 wallets are on the higher end of $10,000 to $100,000 in earnings. On the other hand, nine wallets have lost more than $100,000.

Friend.tech’s growth has exceeded other decentralized social media platforms, and its current success shows how quickly a crypto product can penetrate the market when there’s a strong market fit. The decentralized social media app has demonstrated its potential for gains, but this ultimately boils down to each user’s investment decision. Other analysts have shown skepticism regarding its early success, with some comparing the platform to a Ponzi scheme.

Total crypto market cap at $1.03 trillion on the weekly chart: TradingView.com

If someone can please fill me in, how is #friendTech not a clear as day Ponzi? You buy and if more people buy that group it goes up. The only way to appreciate is more people coming in, with the inevitability of a load of bag holders. What am I missing? pic.twitter.com/NyXvpo1pyT

— TheChartGuys (@ChartGuys) August 21, 2023

At the time of writing, Friend.tech has managed to do well in terms of user base with 233k users. According to one of the core developers behind DeFiLlama, a hack into Friend.tech would be more devastating than the Balancer hack, as users can lose funds by opening the app.

Featured image from Shutterstock