Crypto as an industry seems to be coming out of a “Wild West” zone to be completed regulated and control by every major agency and regulator around the globe. A sector falsely thought to lack regulations, crypto investors know the opposite is the truth rule.

Related Reading | Singapore Authority Gives Crypto Licenses To DBS And Australian Exchange

According to a report by Forkast, the Australian Tax Office (ATO) is concerned that local investors are misreporting their crypto investment. Representatives from the agency claimed in a recent Senate Select Committee that there is a “great deal of misreporting” on crypto-related trading activities.

The report adds that many cryptocurrency investors in Australia could be unaware of their obligations with the Australian Tax Office (ATO). Similar to other parts of the world, if an investor sells, swaps, or trades a cryptocurrency, the transaction is subject to a capital gains tax (CGT).

Therefore, their capital gain or their loss must be reported in their income tax return, Forkast added. A special discount is granted to long-term investors of a cryptocurrency with a mechanism to reduce their tax obligations on capital gains.

During the Senate hearing, the Australian Tax Office also clarified the distinctions for individuals and businesses when reporting crypto profits/losses. In the case of the latter, these entities must report each transaction as a business activity.

Related Reading | Australian Cryptocurrency Exchange Grows Among Veterans That Consider Bitcoin As A Legit Investment

The report quotes Michael Bacina, partner at Piper Alderman and part of the board of Blockchain Australia. Bacina believes crypto tax has been the subject of “misunderstanding”:

the ATO’s response to the committee accords with our view of the tax laws relating to cryptocurrency (…). There is a clear difference in reporting of gains between a person trading crypto as a business and someone trading in their capacity as an individual.

1 Million People Get Into Crypto In Australia

According to the ATO, a person can incur a capital gains tax (CGT) event even if they gift cryptocurrency to someone else, if they dispose of a crypto asset, if they convert their crypto holdings into fiat currency, or if they used to obtain goods or services.

Basically, the only way for an Australian not to be susceptible to a CGT event is to hold on to their crypto funds. The agency clarified:

You will make a capital gain if the capital proceeds from the disposal of the cryptocurrency are more than its cost base. Even if the market value of your cryptocurrency changes, you do not make a capital gain or loss until you dispose of it.

Despite the country’s strict rules on cryptocurrencies, the government estimates that around 1 million Australians have invested in these new asset classes. Some have even started using digital assets recreationally, as seen in the rise of platforms like the best online casinos in Australia that accept crypto deposits for gaming. In the next year, this metric could continue to climb.

Related Reading | Crypto Cards Arrive In Australia. What Are The Tax Implications?

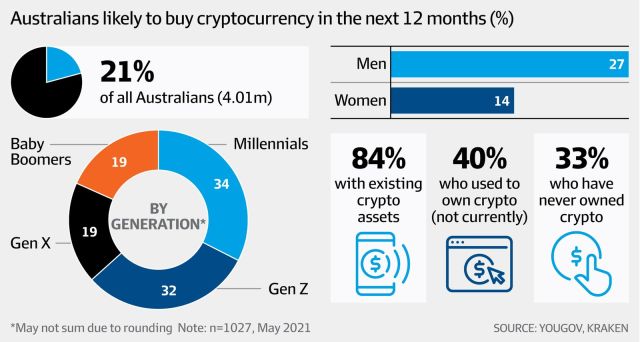

Data from a survey commissioned by crypto exchange Kraken estimates that 4 million Australians are likely to buy Bitcoin, Ethereum, or another form of cryptocurrency. The younger Australian generations are seemed to be drawn into crypto to grow their wealth.

In that sense, over 60% of the respondents in Kraken’s survey said to be likely to sell their crypto assets in the next 12 months with only 23% saying to be unlikely that they would sell their crypto holdings.

At the time of writing, BTC trades at $54,175 with a 1.5 loss in the daily chart.