According to German broker firm Bernstein, Bitcoin (BTC) mining has the potential to be an AI survival, consolidation, and diversification game.

This is coming after BTC mining stocks listed in the United States witnessed substantial growth this year, with their value more than doubling after enduring a downturn in the crypto market in 2022.

This remarkable resurgence has been attributed to two primary factors. The first factor is the robust performance of bitcoin prices, which is because of an enhanced investor sentiment resulting from the recent filing of exchange-traded-fund (ETF) applications by prominent institutional players like BlackRock and Fidelity. These filings have instilled confidence in the market and contributed to the positive trajectory of bitcoin prices.

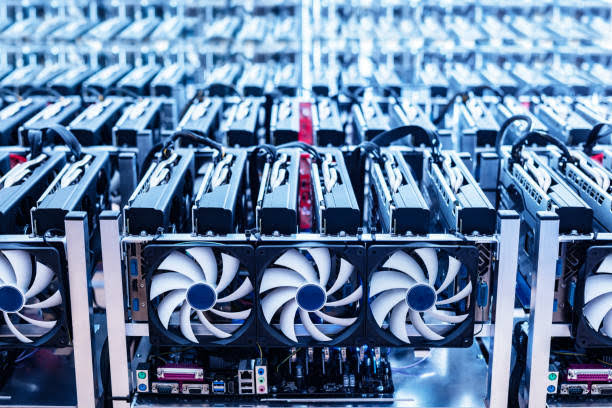

The second factor driving the growth is the utilization of high-performance computing and artificial intelligence (AI) by Bitcoin miners. By incorporating advanced technologies, miners are diversifying their revenue streams and optimizing their mining operations.

ETF Filings And Miner Strategies Drive Growth In The Past Weeks

On June 15, the iShares unit of BlackRock (BLK), a fund management company, submitted documentation to the US Securities and Exchange Commission (SEC) to establish a spot bitcoin (BTC) ETF.

The proposed fund, named the iShares Bitcoin Trust, is expected to primarily hold Bitcoin through a custodian appointed by the trust, as stated in the filing. According to the filing, Coinbase, a prominent cryptocurrency exchange, is said to be the chosen custodian.

On June 27, Bitcoin (BTC) also experienced a mid-morning price spike after asset management behemoth Fidelity was preparing to apply for a spot Bitcoin ETF as soon as the following Tuesday.

This news briefly drove the Bitcoin price up from $30,600 to $31,000 within a few minutes. However, the price quickly reversed, and at the time of press, bitcoin was trading back at $30,500.

Related Reading: Crypto Mining Criminals: Malaysian Power Utility Busts 2 Companies For Electricity Theft

Another contributing factor to the significant growth of Bitcoin this year is that a number of Bitcoin miners are seizing opportunities in high-performance computing and artificial intelligence (AI) to diversify their revenue streams.

Bernstein Analyst Weighs In On The BTC Mining Buzz

Bernstein analyst, Gautam Chhugani stated that the mining situation presents a distinctive game of survival, in which the most efficient miners with low operational costs and conservative debt profiles have the ability to endure, consolidate their capacity and market share, and ultimately generate exceptionally high profits when bitcoin prices surpass production costs.

The broker firm, Bernstein, further highlights that weaker miners burdened with substantial debt are unable to sustain themselves and often succumb to financial difficulties during periods of crypto downturns, citing the recent bankruptcy of Core Scientific (CORZQ) as an example.

The firm observes that the initial phase of consolidation has already taken place, with surviving miners now focusing on expanding their capacity in anticipation of the upcoming Bitcoin halving event.

During this event, mining rewards are reduced by 50%, which historically has resulted in an upward drive in the price of BTC.