After completing the inverse head and shoulders formation Bitcoin price failed to pop. Does this mean the cryptocurrency has further to fall?

Market Overview

As the sky-high bitcon [coin_price] predictions of $25,000, $50,000 and $60,000 continue, there seems to be a divergence between the opinions of billionaires, institutional financial analysts and bitcoin’s actual price. Last week, the explanation for the forever delayed Wall Street crypto bull run was cryptocurrencies being in a ‘healthy’ bottoming process. While this week smart money proposes that institutional investors are waiting for bitcoin to dip down to, or below $5,000 USD before the floodgates burst and billions upon trillions of dollars flow into cryptocurrencies. Or perhaps everyone is waiting on the SEC’s Bitcoin ETF decision next month?

In any case, as journalists, we must remain objective, but it is safe to suspect that average investors are becoming somewhat skeptical as perma-bulls unwaveringly post eternally optimistic predictions and crypto media technical analysts revise their predictions and weekly analysis faster than a purple chameleon on a green leaf.

Here’s a realistic view of bitcoin’s current price action.

Daily Chart

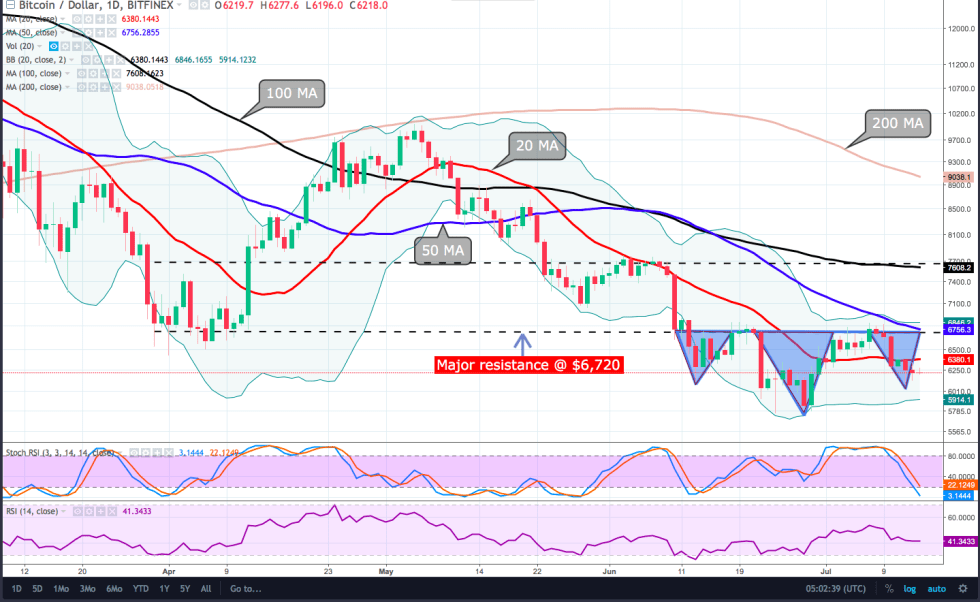

After a rough few days, BTC [coin_price] managed to avoid dipping below $6,000 by a mere $80 bucks and has spent the last day attempting to regain lost ground. While there are whispers of a bullish reversal on the cards, the general outlook remains tipped toward bears as the moving averages all trend downward with 20-MA sharply below the 100 and 50 MA. At the time of writing, the Stoch dives deeply into oversold territory and the RSI has flatlined near 42.

Yesterday’s downturn prompted BTC to complete the inverse head and shoulders formation and an oversold Stoch and flat RSI, which wavers in the crossover zone between bearish and bullish territory could bring about a slight reversal that could see BTC extend toward the 100-MA at $6,400 (See 4-Hour chart) but reaching this level and higher could prove challenging as the 5 and 10 MA slope downward and the space between the two narrows, which is indicative of bearish pressure.

4 Hour Chart

The Bollinger bands are beginning to constrict and traders could keep a close eye on this indicator for additional constriction or even bullish expansion as the inverse head and shoulders structure is already complete and the oversold Stoch (daily chart) may begin a reversal in the near term.

Bitcoin Price: Looking Ahead

BTC remains bearish for the short term even though a sustained BTC price above $6,250 could see an extension to $6,400 but further gains could be challenging as most technical indicators are in favor of bears.

A BTC decline and close below $6,250 could resume the sell-off to $6,000 – $5,800.

[Disclaimer: The views expressed in this article are not intended as investment advice. Market data is provided by BITFINEX. The charts for analysis are provided by TradingView.]

Where do you think Bitcoin price will go this week? Let us know in the comments below!

Images courtesy of ShutterStock, Tradingview.com