- Bitcoin is now caught within an intense uptrend that has sent its price rocketing up to fresh yearly highs, with bulls currently testing these highs as they target further upside

- This strength has come about due to the confluence of multiple positive news developments and has allowed BTC to far outperform the stock market

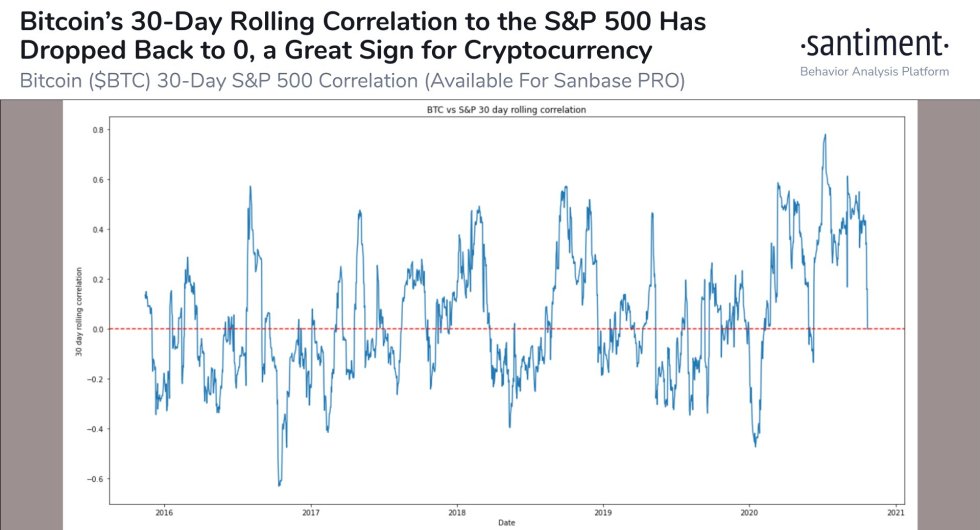

- One bullish result of this recent rally has been Bitcoin’s correlation with the stock market diving to zero

- This correlation previously plagued its price action and stopped it from seeing significant upside

- One analytics firm is now noting that this is an incredibly bullish development

Bitcoin and the entire crypto market have been seeing some immense bullishness throughout the past few days and weeks, with sellers both being unable to gain any strong traction as BTC continues pushing higher.

Each rejection has only created slight selloffs that have been heavily absorbed by bulls. This is a positive sign that points to strength amongst its buyers.

Furthermore, BTC bulls have been catalyzing immense strength as of late, and it does appear that Bitcoin is on track to set significantly higher highs in the near-term.

This has caused its correlation with the stock market to plunge to zero, which is a bullish development.

Bitcoin Rallies to Yearly Highs as Buying Pressure Mounts

At the time of writing, Bitcoin is trading up just under 2% at its current price of $13,150. This is just a hair below its 2020 highs of $13,200 set a few days ago.

This level has proven to be resistance, but each rejection it has faced has grown progressively weaker.

It now appears that BTC is on the cusp of shattering this level and rallying to fresh highs.

BTC Shatters Correlation with the Stock Market

One analytics firm noted that Bitcoin’s correlation with the stock market now sits at zero, which is a bull-favoring development.

“With Bitcoin’s +14.1% price surge this past week, its correlation to the #SP500 has dropped back to 0 for the first time since May on our 30-day rolling average model… BTC has historically thrived when its reliance on world markets, and other asset classes & industries, is minimal, and trading can operate independently…”

Image Courtesy of Santiment.

As long as this trend persists throughout the coming few weeks as the election nears, it could mark the start of a new era in which Bitcoin is fully decoupled from equities.

This would bolster the safe haven narrative that many investors have subscribed to.

Featured image from Unsplash. BTCUSD pricing data from TradingView.