The founder of the on-chain analytics firm CryptoQuant has revealed a Bitcoin metric that has held for its price for the past 15 years.

Bitcoin Has Never Dipped Below Realized Price Of Old Whales

In a new post on X, CryptoQuant founder and CEO Ki Young Ju has talked about the Bitcoin Realized Price of the old whales. The “Realized Price” refers to an on-chain metric that, in short, tells us about the average cost basis of the investors or addresses on the BTC network.

When the asset’s spot price is trading above this indicator, it means the average holder can be assumed to be holding a net amount of profit. On the other hand, the BTC value being under the metric implies the dominance of loss in the market.

In the context current topic, the Realized Price of only a particular segment of the sector is of interest: the old whales, also known as the long-term holder whales.

The long-term holders (LTHs) refer to the Bitcoin investors who have been holding onto their coins since more than 155 days ago. As such, the LTH whales would be the large hands that have kept their coins dormant long enough to fall in this category. More specifically, these are the LTHs with at least 1,000 BTC in their wallets.

Historically, the LTHs have proven themselves to be the resolute hands of the market, who don’t easily sell regardless of what may be going on in the wider market. Whales naturally occupy a key position on the network due to their large holdings, so the LTH whales, in particular, can be important investors to follow.

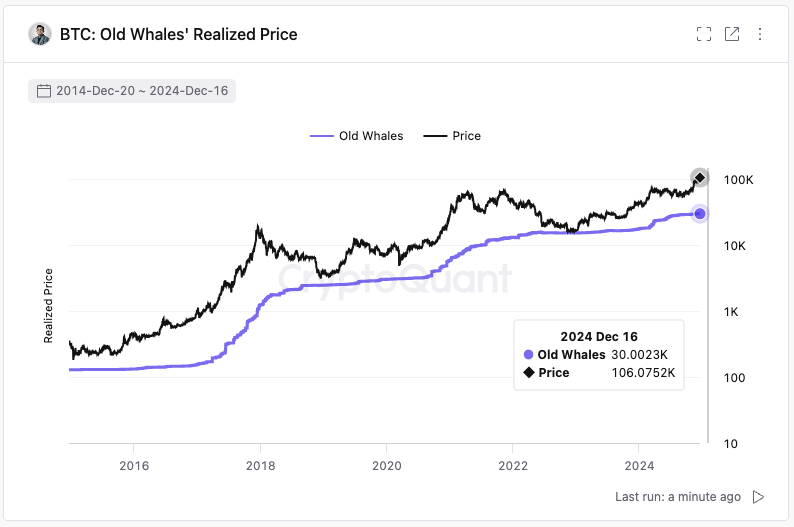

Below is the chart for the Bitcoin Realized Price shared by Young Ju, which shows how the metric’s value has changed for the old whales over the past decade:

The price of the asset appears to be quite far away from this metric right now | Source: @ki_young_ju on X

As displayed in the graph, the spot price of Bitcoin is currently at a significant distance from the Realized Price of the old whales, which implies the patience of these resolute hands has provided them with massive profits.

But more interesting is the historical pattern that the BTC price has followed with respect to this indicator. “For 15 years, Bitcoin has never dropped below the cost basis of long-term whales, which currently stands at $30K,” explains the CryptoQuant founder.

The main intention behind Young Ju’s post wasn’t to reveal this fact, however, it was actually to showcase how the bet of Michael Saylor’s Microstrategy is looking more safe by the day.

The analyst has pointed out that based on BTC holdings alone, the liquidation price of the company would be $16,500. If the past pattern continues to hold for Bitcoin, then it may not fall below $30,000 again, which would imply the firm wouldn’t go under, save for during extraordinary circumstances.

BTC Price

At the time of writing, Bitcoin is floating around $107,000, up almost 10% in the last seven days.

Looks like the price of the coin has been climbing up over the last few days | Source: BTCUSDT on TradingView