The Ethereum ecosystem had a positive run in the second quarter of 2023. From the Shapella upgrade in April to May’s memecoin frenzy, there was a lot of buzz surrounding the most prominent smart contract blockchain.

This was reflected in the network’s on-chain activity and gas fees. According to the quarterly report by blockchain analytics company IntoTheBlock, Ethereum recorded an 83% increase in network fees in the past three months.

Ethereum Network Fees Surge Due To Memecoin Frenzy

The network fee surge experienced by the Ethereum network has been linked to the rise of Ethereum-based memecoins in the Q2 of 2023. In the last few months, new memecoins, like APED, BOBO, PEPE, etc., have taken over the market, with some of these tokens recording huge gains.

According to an IntoTheBlock report, speculative activity in the memecoin market is one of the major forces behind the elevated Ethereum network fees.

The impact of memecoins on Ethereum’s network activity was so high that it caused a shift in the top gas-burning altcoins at some point in April. Meme tokens, such as TROLL, APED, and BOBO, were amongst the top 10 gas-burning altcoins, displacing popular assets, like ETH, Wrapped ETH (WETH), and USDT, from their positions, according to a Santiment analysis.

Interestingly, Bitcoin also saw increased network fees in 2023’s second quarter, resulting from creating tokens via the BRC-20 standard. IntoTheBlock’s report revealed that Bitcoin fees increased by over 300% in the second quarter – the highest since Q2 2021.

Quarterly Update: #Bitcoin transaction fees increased 4x compared to last quarter, marking the highest increase since Q2 2021. The surge is primarily driven by Ordinals-related activity.

Stay tuned, we’ll share more updates on this past quarter in the coming days. pic.twitter.com/sUuilxWBNN— IntoTheBlock (@intotheblock) June 30, 2023

It is worth noting that the Ethereum network fees have cooled since the May highs, returning to a range of 15-20 Gwei in recent weeks.

ETH Supply Reached All-Time Low In May

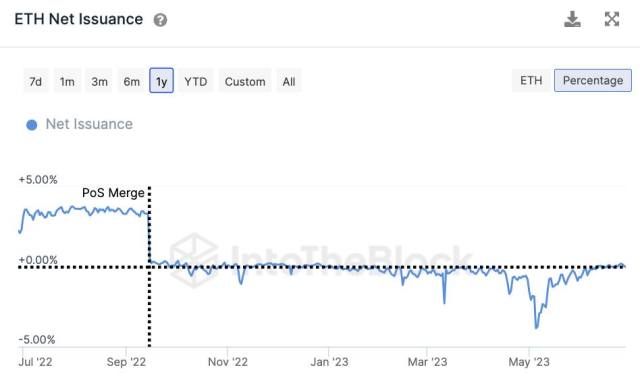

While Ethereum’s network fees rose in May, the supply of Ether tanked, reaching its all-time low. According to IntoTheBlock’s analysis, Ether’s annualized net issuance rate dropped as low as 3.75% during the memecoin frenzy.

Following the Merge last September, the amount of ETH issued per block dipped by 90%, making Ether more prone to deflation during fee spikes. Notably, the ETH supply trend has stabilized since the network fees dropped back into the normal range.

Source: IntoTheBlock

According to CoinGecko data, ETH trades at $1,935, gaining 4.6% in the past 24 hours. The token is the second-largest cryptocurrency, with a market cap of roughly $233 billion.

ETHUSD trading at $1,922 | Source: ETHUSD chart from TradingView