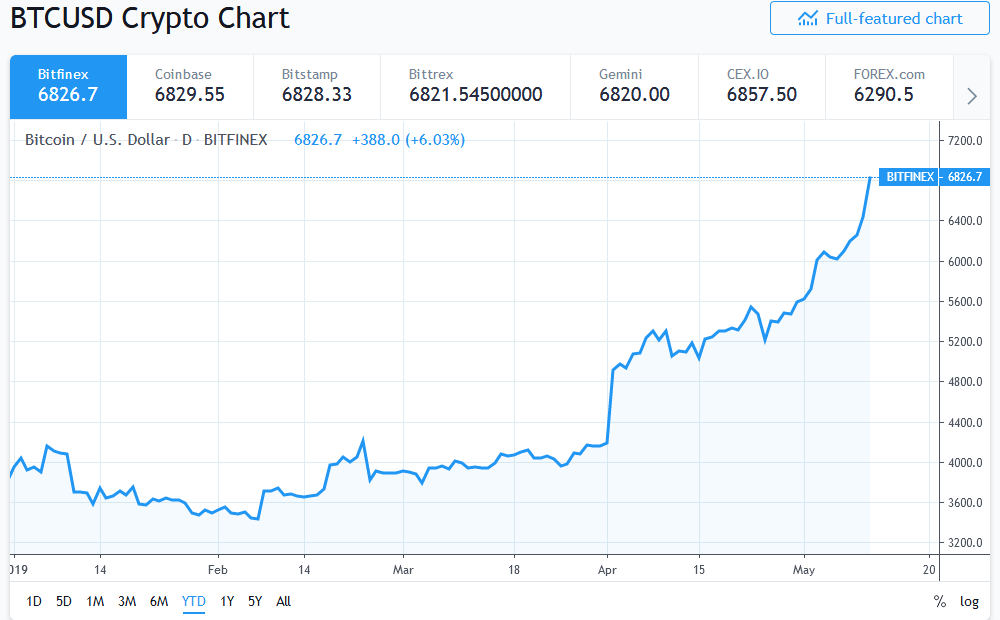

Remember when the slightest bit of negative or positive development would cause the Bitcoin price action to change drastically? Well, those days seem to be long gone leading many to opine that BTC is becoming a much more mature asset. Here are four examples that show BTC is no longer swayed by every bit of news that emerges in the market.

Bitcoin Shrugs Off Bitfinex-Tether Fiasco

At the back end of April, the New York Attorney General (NYAG) accused Bitfinex and Tether (USDT) of covering losses of up to $850 million. The revelation was the latest salvo in the long-running Tether/Bitfinex controversy.

When the news broke out, BTC dipped slightly as Bitfinex users understandably dumped USDT. In the past, a story like this would have had a catastrophic impact on Bitcoin’s positive market sentiment.

Instead, as swiftly as the dip occurred, BTC was back in the green and even moved beyond the $5,500 mark it occupied when the news broke out.

By May 1, 2019, as reported by Bitcoinist, Bitcoin had broken through $5,600.

Exchange Hacks No Longer Tank The Market

Exchange hacks result in stolen cryptocurrency. This means market panic. Right? Mt. Gox in 2014 certainly put an end to that bubble. Well, these days, not so much.

Hackers have hit a few platforms since the start of 2019 but BTC has largely remained unaffected by such happenings.

Binance, arguably the golden standard of centralized exchanges today, got hit for $40 million in BTC with hardly a blip in the Bitcoin price.

In fact, the market became even more bullish; and it’s no coincidence that the thieves stole bitcoin only, by the way.

Why? Well, the CEO of Binance, Changpeng Zhao, quickly realized that Bitcoin is the most immutable ledger after discussing the situation with experts. Thus, Bitcoin is the world’s most neutral financial network. This means no rollbacks, retries, bail-ins or bail-outs.

To put this to bed, it's not possible, bitcoin ledger is the most immutable ledger on the planet. Done. https://t.co/rKLBCEZmgp

— CZ 🔶 BNB (@cz_binance) May 8, 2019

Notably, the blockchain reorg idea getting shot down so quickly, some have argued, was another bullish sign further confirming that bitcoin has no central authority.

CZ has since publicly apologized for bringing up the idea.

Institutions Are Entering Despite Anti-BTC Sentiment

There are also reports that major brokers and investment giants such as Ameritrade, E-Trade and Fidelity are set to offer BTC trading.

Meanwhile, on Thursday, the U.S. Financial Crimes Enforcement Network (FinCEN) released an updated guidance sheet detailing that some cryptocurrency businesses are operating as money transmitters based on the country’s Bank Secrecy Act (BSA).

Some of the platforms identified in the document include Bitcoin ATMs, mining pools, peer-to-peer (P2P) platforms, cryptocurrency mixers to mention a few.

Such businesses would have to obtain money transmitter licenses and be compliant with know-your-customer (KYC) and anti-money laundering (AML) protocols.

Thanks, Bitcoin Naysayers For The Streisand Effect

In May 2019, the usual suspects like Nouriel Roubini and Warren Buffett have issued their familiar anti-BTC diatribe. Another Nobel Laureate Joseph Stiglitz also called for cryptocurrencies to be shut down.

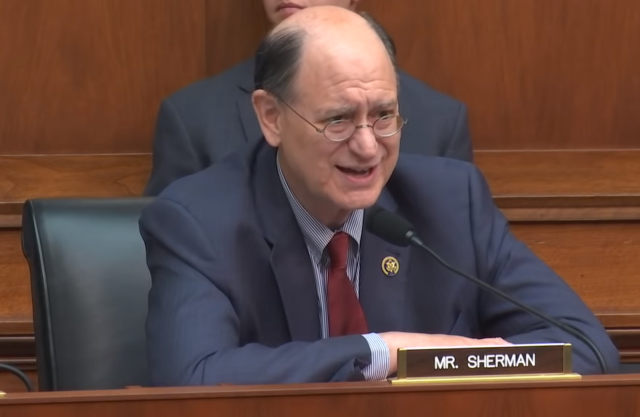

Then, what Bitcoinist senior market analyst Filb Filb called “the icing on the cake,” came on Friday. US Congressman Brad Sherman called, with blatant honesty, for a ban on Bitcoin fearing that it undermines the dollar’s hegemony on the world stage.

In other words, every country that’s not a fan of the dollar as the world reserve currency (think China and Russia), now have official confirmation from an American political that Bitcoin is a threat to this paradigm.

Russia, for example, is already rumored to be buying up billions in bitcoin to evade US sanctions and avoid relying on US-controlled gold markets.

Therefore, we are witnessing as Bitcoin is not only becoming a more mature asset class but one that may be entering the world of geopolitics.

Do you agree that Bitcoin is now a more mature asset? Share your thoughts below!

Images via Tradingview, Shutterstock